题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

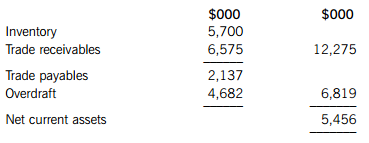

The current assets and current liabilities of CSZ Co at the end of March 2014 are as follo

For the year to end of March 2014, CSZ Co had domestic and foreign sales of $40 million, all on credit, while cost of sales was $26 million. Trade payables related to both domestic and foreign suppliers.

For the year to end of March 2015, CSZ Co has forecast that credit sales will remain at $40 million while cost of sales will fall to 60% of sales. The company expects current assets to consist of inventory and trade receivables, and current liabilities to consist of trade payables and the company’s overdraft.

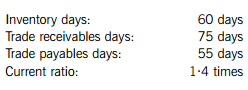

CSZ Co also plans to achieve the following target working capital ratio values for the year to the end of March 2015:

Required:

(a) Calculate the working capital cycle (cash collection cycle) of CSZ Co at the end of March 2014 and discuss whether a working capital cycle should be positive or negative. (6 marks)

(b) Calculate the target quick ratio (acid test ratio) and the target ratio of sales to net working capital of CSZ Co at the end of March 2015. (5 marks)

(c) Analyse and compare the current asset and current liability positions for March 2014 and March 2015, and discuss how the working capital financing policy of CSZ Co would have changed. (8 marks)

(d) Briefly discuss THREE internal methods which could be used by CSZ Co to manage foreign currency transaction risk arising from its continuing business activities. (6 marks)

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案