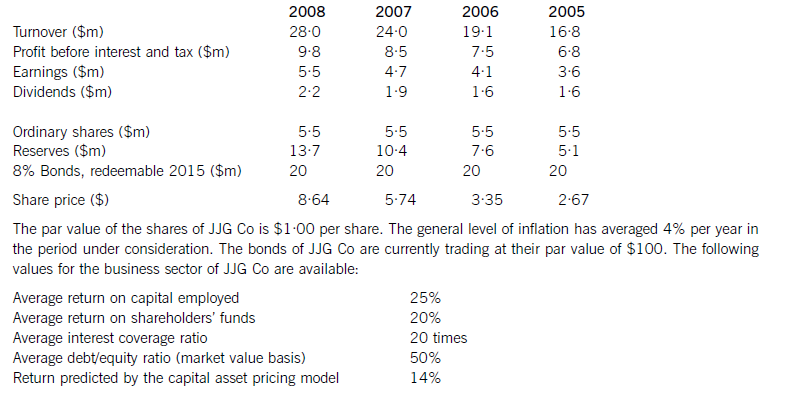

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

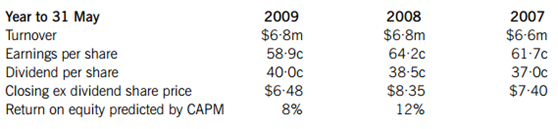

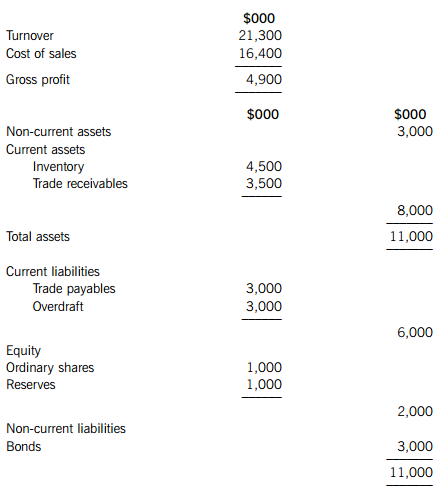

Extracts from the recent financial statements of Bold Co are given below.A factor has offe

Extracts from the recent financial statements of Bold Co are given below.

A factor has offered to manage the trade receivables of Bold Co in a servicing and factor-financing agreement. The factor expects to reduce the average trade receivables period of Bold Co from its current level to 35 days; to reduce bad debts from 0·9% of turnover to 0·6% of turnover; and to save Bold Co $40,000 per year in administration costs. The factor would also make an advance to Bold Co of 80% of the revised book value of trade receivables. The interest rate on the advance would be 2% higher than the 7% that Bold Co currently pays on its overdraft. The factor would charge a fee of 0·75% of turnover on a with-recourse basis, or a fee of 1·25% of turnover on a non-recourse basis. Assume that there are 365 working days in each year and that all sales and supplies are on credit.

Required:

(a) Explain the meaning of the term ‘cash operating cycle’ and discuss the relationship between the cash operating cycle and the level of investment in working capital. Your answer should include a discussion of relevant working capital policy and the nature of business operations. (7 marks)

(b) Calculate the cash operating cycle of Bold Co. (Ignore the factor’s offer in this part of the question). (4 marks)

(c) Calculate the value of the factor’s offer:

(i) on a with-recourse basis;

(ii) on a non-recourse basis. (7 marks)

(d) Comment on the financial acceptability of the factor’s offer and discuss the possible benefits to Bold Co of factoring its trade receivables. (7 marks)

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案