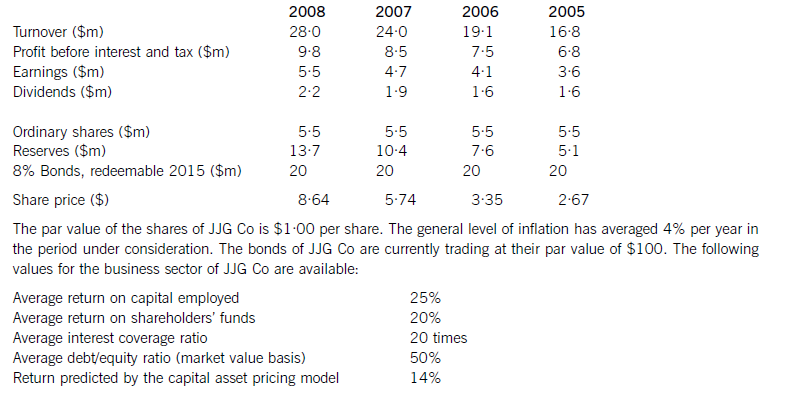

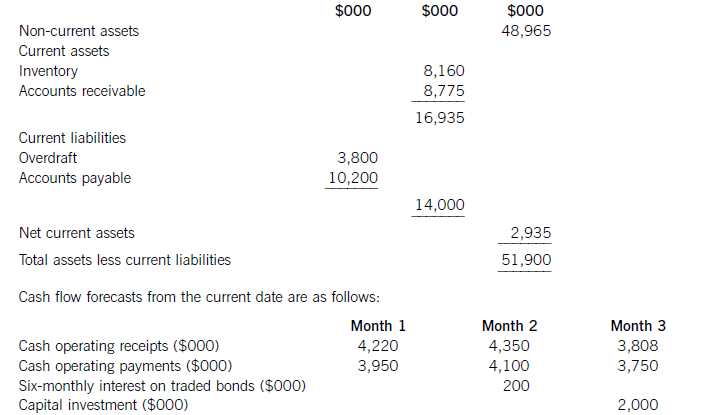

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

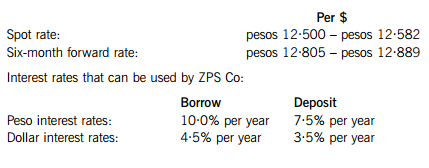

(a) ZPS Co, whose home currency is the dollar, took out a fixed-interest peso bank loan se

(a) ZPS Co, whose home currency is the dollar, took out a fixed-interest peso bank loan several years ago when peso interest rates were relatively cheap compared to dollar interest rates. Economic difficulties have now increased peso interest rates while dollar interest rates have remained relatively stable. ZPS Co must pay interest of 5,000,000 pesos in six months’ time. The following information is available.

Required:

(i) Explain briefly the relationships between;

(1) exchange rates and interest rates;

(2) exchange rates and inflation rates. (5 marks)

(ii) Calculate whether a forward market hedge or a money market hedge should be used to hedge the interest payment of 5 million pesos in six months’ time. Assume that ZPS Co would need to borrow any cash it uses in hedging exchange rate risk. (6 marks)

(b) ZPS Co places monthly orders with a supplier for 10,000 components that are used in its manufacturing processes. Annual demand is 120,000 components. The current terms are payment in full within 90 days, which ZPS Co meets, and the cost per component is $7·50. The cost of ordering is $200 per order, while the cost of holding components in inventory is $1·00 per component per year.

The supplier has offered either a discount of 0·5% for payment in full within 30 days, or a discount of 3·6% on orders of 30,000 or more components. If the bulk purchase discount is taken, the cost of holding components in inventory would increase to $2·20 per component per year due to the need for a larger storage facility.

Assume that there are 365 days in the year and that ZPS Co can borrow short-term at 4·5% per year.

Required:

(i) Discuss the factors that influence the formulation of working capital policy; (7 marks)

(ii) Calculate if ZPS Co will benefit financially by accepting the offer of:

(1) the early settlement discount;

(2) the bulk purchase discount. (7 marks)

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案