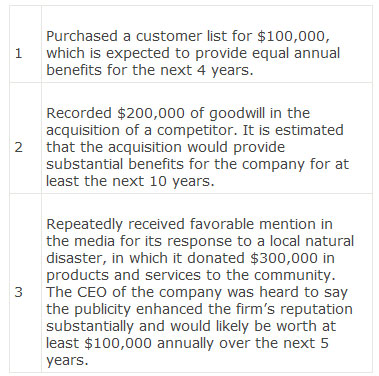

题目内容

(请给出正确答案)

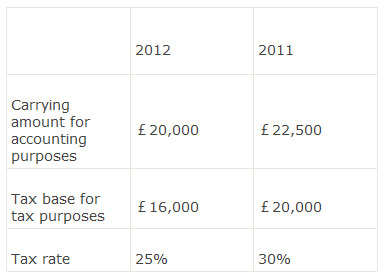

题目内容

(请给出正确答案)

Two companies are identical except for their accounting treatment of research and dev

A、earn a lower ROA

B、have a lower financial leverage、

C、report lower cash flow from operations in the statement of cash flows.

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案