题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Assume U.S.GAAP (generally accepted accounting principles) applies unless otherwise n

Assume U.S.GAAP (generally accepted accounting principles) applies unless otherwise noted.

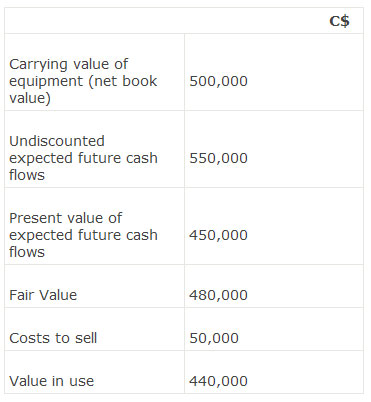

A company has equipment with an original cost of $850,000, accumulated amortization of $300,000 and 5 years of estimated remaining useful life.Due to a change in market conditions the company now estimates that the equipment will only generate cash flows of $80,000 per year over its remaining useful life.The company’s incremental borrowing rate is 8 percent.Which of the following statements concerning impairment and future return on assets (ROA) is most accurate? The asset is:

A.impaired and future ROA increases.

B.impaired and future ROA decreases.

C.not impaired and future ROA increases.

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案