题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

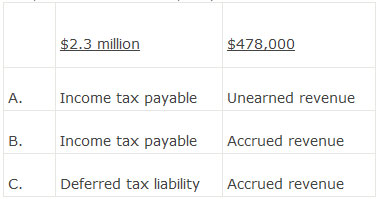

When the Bao Company filed its corporate tax returns for the first quarter of the current year, it owed

a total of $6.7 million in corporate taxes. Bao paid $4.4 million of the tax bill, but still owes $2.3 million. It also received $478,000 in the second quarter as a down payment towards $942,000 in custom-built products to be delivered in the third quarter. Its financial accounts for the second for the second quarter most likely show the $2.3 million and the $478,000 as:

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案