题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Bao Inc. issued its Class H series bonds at $10,400 on 1/1/x3. Class H bonds have a 1

A. $405.

B. $808.

C. $1,000.

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A. $405.

B. $808.

C. $1,000.

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

更多“Bao Inc. issued its Class H se…”相关的问题

更多“Bao Inc. issued its Class H se…”相关的问题

第1题

e:

A. only the annual lease payment.

B. minimum lease payments for each of the next five years and the sum of lease payments more than five years in the future.

C. minimum lease payments for each of the next ten years and the sum of lease payments more than ten years in the future.

第2题

firm does not use the fair value reporting option, how is the change in the market value of the firm’s debt most likely to be reported in the firm’s financial statements?

A. The gain or loss in market value must be calculated and disclosed in the footnotes to the financial statements.

B. Net income and equity are unaffected, but the change is disclosed by the firm’s management.

C. Net income is unaffected, but the change in market value is recorded in other comprehensive income.

第3题

the bonds on the 2008 balance sheet will be:

A. market value.

B. historical cost.

C. amortized cost.

第4题

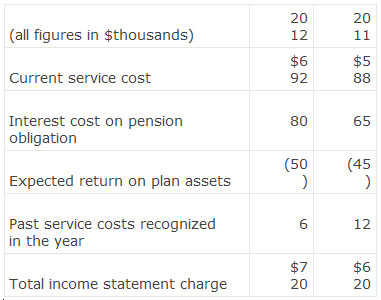

The following information is available from a company’s 2012 financial statements:

Note 6: employee costs.

Note 17: retirement benefit obligations

Amounts recognized in the income statement for the year

The pension expense (thousands) reported in 2012 is closest to:

A.$1,525.

B.$2,217.

C.$2,253.

第5题

od of amortizing bond premium and discount?

A. using the effective interest method results in a different interest expense each period.

B. The coupon interest rate is the market interest rate at the time the debt was issued.

C. A bond sells at a premium when the market interest rate exceeds the coupon rate.

第6题

pay a 4.5% coupon, mature in three years, and have net book value of $785,000.The bonds are convertible into 20,000 shares of common stock, with a $1 par value.The current market value of the common shares is $62.50.Under U.S.GAAP, the amount that will be recorded as additional paid-in capital if the bonds are immediately converted is closest to:

A.$115,000.

B.$765,000.

C.$1,250,000.

第7题

t bond is paid semiannually, the annual coupon rate on the bond is 9%, and the bond matures in ten years.The market rate of the interest at the time the bond was issued was 10% on an annual basis.The amount of the initial liability recorded for this bond was closest to:

A.$938.

B.$961.

C.1,065.

第8题

rate of 8% payable semi-annually on 30 June and 31 December:

Issued on 1 January 2005, when the market rate of interest was 6%.

Bought back in an open market transaction on 1 January 2011, when the market rate of interest rate was 8%.

Which of the following statements best describes the effect of the bond repurchase on the financial statements for 2011? If the company uses the indirect method of calculating the cash from operations, there will be a:

A.$346,511 gain on the income statement.

B.$743,873 gain on the income statement.

C.$350,984 decrease in the cash from operations.

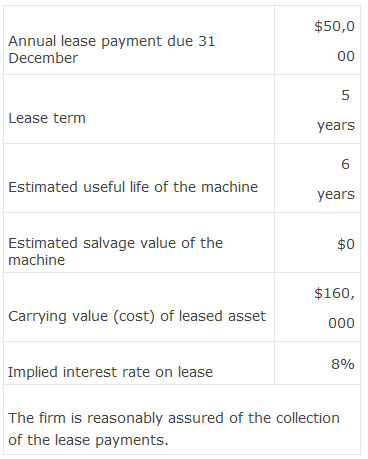

第9题

as the lessor with the following terms:

The total affect on 2012 pre-tax income for the lessor from this lease is closest to:

A.$32,143.

B.$75,000.

C.$82,519.

第10题

as the lessor with the following terms:

Which of the following best describes the classification of the lease on the company’s financial statements for 2008?

A.Operating lease.

B.Sales type lease.

C.Direct financing lease.

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!

微信搜一搜

微信搜一搜

上学吧

上学吧

微信搜一搜

微信搜一搜

上学吧

上学吧