题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

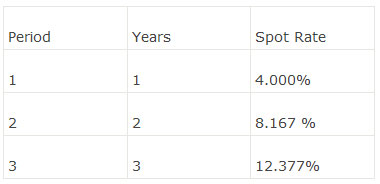

The U.S. Treasury spot rates are provided in the following table:Consider a 3-year, 9%

The U.S. Treasury spot rates are provided in the following table:

Consider a 3-year, 9% annual coupon corporate bond currently trading at $89.464. Given the YTM of a 3-year Treasury is 12%, the Z- spread of the corporate bond is closest to:

A. 1.50%.

B. 1.67%.

C. 1.76%.

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案