题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Z Co has a year end of 30 June 20X4. Management has assessed the ability of the company to

A、Analysis of cash flow forecasts

B、Review of board minutes

C、Review of loan terms

D、Inquiry of management

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A、Analysis of cash flow forecasts

B、Review of board minutes

C、Review of loan terms

D、Inquiry of management

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

更多“Z Co has a year end of 30 June…”相关的问题

更多“Z Co has a year end of 30 June…”相关的问题

第1题

Parket Co made a mark-up on cost of 25% on all sales to Suket Co.

What is Parket Co’s consolidated cost of sales for the year ended 31 March 20X7?

A.$954,000

B.$950,000

C.$774,000

D.$766,000

第2题

A、Request that management extends the assessment period to 30 September 20X5

B、Request that management extends the assessment period to 31 December 20X5

C、Request that management extends the assessment period to 31 December 20X6

D、No action is required provided the auditor is satisfied with management's assessment to 30 June 20X5

第3题

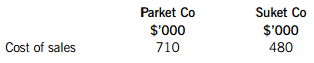

Parket Co acquired 60% of Suket Co on 1 January 20X7. The following extract has been taken from the individual statements of profit or loss for the year ended 31 March 20X7: Parket Co Suket Co $'000 $'000 Cost of sales 710 480 Parket Co consistently made sales of $20,000 per month to Suket Co throughout the year. At the year end, Suket Co held $20,000 of this in inventory. Parket Co made a mark-up on cost of 25% on all sales to Suket Co. Using the drop down box select the correct figure for Parket Co's consolidated cost of sales for the year ended 31 March 20X7?

A、$954,000

B、$950,000

C、$774,000

D、$766,000

第4题

The trainee accountant at Judd Co has forgotten to make an accrual for rent for December in the financial statements for the year ended 31 December 20X2. Rent is charged in arrears at the end of February, May, August and November each year. The bill payable in February is expected to be $30,000. Judd Co’s draft statement of profit or loss shows a profit of $25,000 and draft statement of financial position shows net assets of $275,000. What is the profit or loss for the year and what is the net asset position after the accrual has been included in the financial statements?

A、Profit for the year Net asset position $15,000 $265,000

B、Profit for the year Net asset position $15,000 $285,000

C、Profit for the year Net asset position $35,000 $265,000

D、Profit for the year Net asset position $35,000 $285,000

第5题

Clarinet Co (Clarinet) is a computer hardware specialist and has been trading for over five years. The company is funded partly through overdrafts and loans and also by several large shareholders; the year end is 30 April 2014.

Clarinet has experienced significant growth in previous years; however, in the current year a new competitor, Drums Design Co (Drums), has entered the market and through competitive pricing has gained considerable market share from Clarinet. One of Clarinet’s larger customers has stopped trading with them and has moved its business to Drums. In addition, a number of Clarinet’s specialist developers have left the company and joined Drums. Clarinet has found it difficult to replace these employees due to the level of their skills and knowledge. Clarinet has just received notification that its main supplier who provides the company with specialist electrical equipment has ceased to trade.

Clarinet is looking to develop new products to differentiate itself from the rest of its competitors. It has approached its shareholders to finance this development; however, they declined to invest further in Clarinet. Clarinet’s loan is long term and it has met all repayments on time. The overdraft has increased significantly over the year and the directors have informed you that the overdraft facility is due for renewal next month, and they are confident it will be renewed.

The directors have produced a cash flow forecast which shows a significantly worsening position over the coming 12 months. They are confident with the new products being developed, and in light of their trading history of significant growth, believe it is unnecessary to make any disclosures in the financial statements regarding going concern.

At the year end, Clarinet received notification from one of its customers that the hardware installed by Clarinet for the customers’ online ordering system has not been operating correctly. As a result, the customer has lost significant revenue and has informed Clarinet that they intend to take legal action against them for loss of earnings. Clarinet has investigated the problem post year end and discovered that other work-in-progress is similarly affected and inventory should be written down. The finance director believes that as this misstatement was identified after the year end, it can be amended in the 2015 financial statements.

Required:

(a) Describe the procedures the auditors of Clarinet Co should undertake in relation to the uncorrected inventory misstatement identified above. (4 marks)

(b) Explain SIX potential indicators that Clarinet Co is not a going concern. (6 marks)

(c) Describe the audit procedures which you should perform. in assessing whether or not Clarinet Co is a going concern. (6 marks)

(d) The auditors have been informed that Clarinet’s bankers will not make a decision on the overdraft facility until after the audit report is completed. The directors have now agreed to include some going concern disclosures.

Required:

Describe the impact on the audit report of Clarinet Co if the auditor believes the company is a going concern but that this is subject to a material uncertainty. (4 marks)

第6题

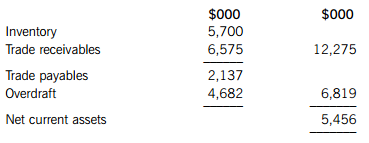

For the year to end of March 2014, CSZ Co had domestic and foreign sales of $40 million, all on credit, while cost of sales was $26 million. Trade payables related to both domestic and foreign suppliers.

For the year to end of March 2015, CSZ Co has forecast that credit sales will remain at $40 million while cost of sales will fall to 60% of sales. The company expects current assets to consist of inventory and trade receivables, and current liabilities to consist of trade payables and the company’s overdraft.

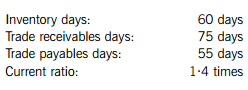

CSZ Co also plans to achieve the following target working capital ratio values for the year to the end of March 2015:

Required:

(a) Calculate the working capital cycle (cash collection cycle) of CSZ Co at the end of March 2014 and discuss whether a working capital cycle should be positive or negative. (6 marks)

(b) Calculate the target quick ratio (acid test ratio) and the target ratio of sales to net working capital of CSZ Co at the end of March 2015. (5 marks)

(c) Analyse and compare the current asset and current liability positions for March 2014 and March 2015, and discuss how the working capital financing policy of CSZ Co would have changed. (8 marks)

(d) Briefly discuss THREE internal methods which could be used by CSZ Co to manage foreign currency transaction risk arising from its continuing business activities. (6 marks)

第7题

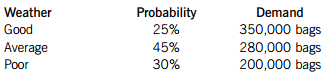

Each bag of cement sells for $9 and costs $4 to make. If cement is unsold at the end of the year, it has to be disposed of at a cost of $0·50 per bag.

Cement Co has decided to produce at one of the three levels of production to match forecast demand. It now has to decide which level of cement production to select.

Required:

(a) Construct a pay off table to show all the possible profit outcomes. (8 marks)

(b) Decide the level of cement production the company should choose, based on the following decision rules:

(i) Maximin (1 mark)

(ii) Maximax (1 mark)

(iii) Expected value (4 marks)

You must justify your decision under each rule, showing all necessary calculations.

(c) Describe the ‘maximin’ and ‘expected value’ decision rules, explaining when they might be used and the attitudes of the decision makers who might use them. (6 marks)

第8题

Hawthorn Enterprises Co

Hawthorn Enterprises Co (Hawthorn) manufactures and distributes fashion clothing to retail stores. Its year end was 31 March 2015. You are the audit manager and the year-end audit is due to commence shortly. The following three matters have been brought to your attention.

Hawthorn receives monthly statements from its main suppliers and although these have been retained, none have been reconciled to the payables ledger as at 31 March 2015. The engagement partner has asked the audit senior to recommend the procedures to be performed on supplier statements.(3 marks)

(ii) Bank reconciliation

During last year’s audit of Hawthorn’s bank and cash, significant cut off errors were discovered with a number of post year-end cheques being processed prior to the year end to reduce payables. The finance director has assured the audit engagement partner that this error has not occurred again this year and that the bank reconciliation has been carefully prepared. The audit engagement partner has asked that the bank reconciliation is comprehensively audited. (4 marks)

(iii) Receivables

Hawthorn’s receivables ledger has increased considerably during the year, and the year-end balance is $2·3 million compared to $1·4 million last year. The finance director of Hawthorn has requested that a receivables circularisation is not carried out as a number of their customers complained last year about the inconvenience involved in responding. The engagement partner has agreed to this request, and tasked you with identifying alternative procedures to confirm the existence and valuation of receivables. (5 marks)

Required:

Describe substantive procedures you would perform. to obtain sufficient and appropriate audit evidence in relation to the above three matters.

Note: The mark allocation is shown against each of the three matters above.

第9题

A、Return some inventory which had been purchased for cash and obtain a full refund on the cost

B、Make a bulk purchase of inventory for cash to obtain a large discount

C、Make an early payment to suppliers, even though the amount is not due

D、Offer early payment discounts in order to collect receivables more quickly

第10题

A、31 July 20X4

B、10 September 20X4

C、30 September 20X4

D、1 November 20X4

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!

微信搜一搜

微信搜一搜

上学吧

上学吧

微信搜一搜

微信搜一搜

上学吧

上学吧