题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Fees are payable at the time of______.

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

更多“Fees are payable at the time o…”相关的问题

更多“Fees are payable at the time o…”相关的问题

第2题

A、bunker costs

B、port charges

C、loading and discharging fees

D、Wages of crew

第3题

When is the office open?

A.Every day of the week.

B.Only on Monday.

C.Only on Friday.

D.Monday through Friday.

第4题

1.Stride Along Inc. has total assets of $440 million. Its equity is $330 million. Net income is $132 million. Total number of outstanding shares is $880 million. Calculate the debt ratio, ROA, ROE, EPS.(10分) 2. Classify the following items as (a) prepaid expense, (b) unearned revenue, (c) accrued expense, (d) accrued revenue.(10分) 1) Supplies on hand 2) Fees earned but not yet received 3) Fees received but not yet earned 4) A two-year premium paid on a fire insurance policy 5) Taxed owed and payable in the following period 6) Utilities owed but not yet paid 7) Salary owed but not yet paid 8) Subscriptions received in advance by a magazine publisher. 3. After all revenue and expense accounts have been closed at the end of the fiscal year 2014, Income Summary has a debit of $312,600 and a credit of $480,150. At the same date, Peter Wills, Capital as a credit balance of $142,350, and Peter Wills, Withdrawal has a debit balance of $25,000.(10分) 1) Determine the double entries (accounting) required to complete the closing of the accounts. 2) Determinethe balance of Peter Wills, Capital at the end of the period.

第5题

Adana died on 17 March 2016, and inheritance tax (IHT) of £566,000 is payable in respect of her chargeable estate. Under the terms of her will, Adana left her entire estate to her children.

At the date of her death, Adana had the following debts and liabilities:

(1) An outstanding interest-only mortgage of £220,000.

(2) Income tax of £43,700 payable in respect of the tax year 2015–16.

(3) Legal fees of £4,600 incurred by Adana’s sister which Adana had verbally promised to pay.

Adana’s husband had died on 28 May 2006, and only 20% of his inheritance tax nil rate band was used on his death. The nil rate band for the tax year 2006–07 was £285,000.

On 22 April 2006, Adana had made a chargeable lifetime transfer of shares valued at £500,000 to a trust. Adana paid the lifetime IHT of £52,250 arising from this gift. If Adana had not made this gift, her chargeable estate at the time of her death would have been £650,000 higher than it otherwise was. This was because of the subsequent increase in the value of the gifted shares.

What is the maximum nil rate band which will have been available when calculating the IHT of £566,000 payable in respect of Adana’s chargeable estate?

A.£325,000

B.£553,000

C.£390,000

D.£585,000

What is the total amount of deductions which would have been permitted in calculating Adana’s chargeable estate for IHT purposes?A.£263,700

B.£268,300

C.£43,700

D.£220,000

Who will be responsible for paying the IHT of £566,000 in respect of Adana’s chargeable estate, and what is the due date for the payment of this liability?A.The beneficiaries of Adana’s estate (her children) on 30 September 2016

B.The beneficiaries of Adana’s estate (her children) on 17 September 2016

C.The personal representatives of Adana’s estate on 30 September 2016

D.The personal representatives of Adana’s estate on 17 September 2016

How much IHT did Adana save by making the chargeable lifetime transfer of £500,000 to a trust on 22 April 2006, rather than retaining the gifted investments until her death?A.£260,000

B.£207,750

C.£147,750

D.£200,000

How much of the IHT payable in respect of Adana’s estate would have been saved if, under the terms of her will, Adana had made specific gifts of £400,000 to a trust and £200,000 to her grandchildren, instead of leaving her entire estate to her children?A.£240,000

B.£160,000

C.£0

D.£80,000

第6题

The following scenario relates to questions 1–5.

Adana died on 17 March 2016, and inheritance tax (IHT) of £566,000 is payable in respect of her chargeable estate. Under the terms of her will, Adana left her entire estate to her children.

At the date of her death, Adana had the following debts and liabilities:

(1) An outstanding interest-only mortgage of £220,000.

(2) Income tax of £43,700 payable in respect of the tax year 2015–16.

(3) Legal fees of £4,600 incurred by Adana’s sister which Adana had verbally promised to pay.

Adana’s husband had died on 28 May 2006, and only 20% of his inheritance tax nil rate band was used on his death. The nil rate band for the tax year 2006–07 was £285,000.

On 22 April 2006, Adana had made a chargeable lifetime transfer of shares valued at £500,000 to a trust. Adana paid the lifetime IHT of £52,250 arising from this gift. If Adana had not made this gift, her chargeable estate at the time of her death would have been £650,000 higher than it otherwise was. This was because of the subsequent increase in the value of the gifted shares.

What is the maximum nil rate band which will have been available when calculating the IHT of £566,000 payable in respect of Adana’s chargeable estate?

A.£325,000

B.£553,000

C.£390,000

D.£585,000

What is the total amount of deductions which would have been permitted in calculating Adana’s chargeable estate for IHT purposes?A.£263,700

B.£268,300

C.£43,700

D.£220,000

Who will be responsible for paying the IHT of £566,000 in respect of Adana’s chargeable estate, and what is the due date for the payment of this liability?A.The beneficiaries of Adana’s estate (her children) on 30 September 2016

B.The beneficiaries of Adana’s estate (her children) on 17 September 2016

C.The personal representatives of Adana’s estate on 30 September 2016

D.The personal representatives of Adana’s estate on 17 September 2016

How much IHT did Adana save by making the chargeable lifetime transfer of £500,000 to a trust on 22 April 2006, rather than retaining the gifted investments until her death?A.£260,000

B.£207,750

C.£147,750

D.£200,000

How much of the IHT payable in respect of Adana’s estate would have been saved if, under the terms of her will, Adana had made specific gifts of £400,000 to a trust and £200,000 to her grandchildren, instead of leaving her entire estate to her children?A.£240,000

B.£160,000

C.£0

D.£80,000

请帮忙给出每个问题的正确答案和分析,谢谢!

第7题

3 Assume that today’s date is 10 May 2005.

You have recently been approached by Fred Flop. Fred is the managing director and 100% shareholder of Flop

Limited, a UK trading company with one wholly owned subsidiary. Both companies have a 31 March year-end.

Fred informs you that he is experiencing problems in dealing with aspects of his company tax returns. The company

accountant has been unable to keep up to date with matters, and Fred also believes that mistakes have been made

in the past. Fred needs assistance and tells you the following:

Year ended 31 March 2003

The corporation tax return for this period was not submitted until 2 November 2004, and corporation tax of £123,500

was paid at the same time. Profits chargeable to corporation tax were stated as £704,300.

A formal notice (CT203) requiring the company to file a self-assessment corporation tax return (dated 1 February

2004) had been received by the company on 4 February 2004.

A detailed examination of the accounts and tax computation has revealed the following.

– Computer equipment totalling £50,000 had been expensed in the accounts. No adjustment has been made in

the tax computation.

– A provision of £10,000 was made for repairs, but there is no evidence of supporting information.

– Legal and professional fees totalling £46,500 were allowed in full without any explanation. Fred has

subsequently produced the following analysis:

Analysis of legal & professional fees

£

Legal fees on a failed attempt to secure a trading loan 15,000

Debt collection agency fees 12,800

Obtaining planning consent for building extension 15,700

Accountant’s fees for preparing accounts 14,000

Legal fees relating to a trade dispute 19,000

– No enquiry has yet been raised by the Inland Revenue.

– Flop Ltd was a large company in terms of the Companies Act definition for the year in question.

– Flop Ltd had taxable profits of £595,000 in the previous year.

Year ended 31 March 2004

The corporation tax return has not yet been submitted for this year. The accounts are late and nearing completion,

with only one change still to be made. A notice requiring the company to file a self-assessment corporation tax return

(CT203) dated 27 July 2004 was received on 1 August 2004. No corporation tax has yet been paid.

1 – The computation currently shows profits chargeable to corporation tax of £815,000 before accounting

adjustments, and any adjustments for prior years.

– A company owing Flop Ltd £50,000 (excluding VAT) has gone into liquidation, and it is unlikely that any of this

money will be paid. The money has been outstanding since 3 September 2003, and the bad debt will need to

be included in the accounts.

1 Fred also believes there are problems in relation to the company’s VAT administration. The VAT return for the quarter

ended 31 March 2005 was submitted on 5 May 2005, and VAT of £24,000 was paid at the same time. The previous

return to 31 December 2004 was also submitted late. In addition, no account has been made for the VAT on the bad

debt. The VAT return for 30 June 2005 may also be late. Fred estimates the VAT liability for that quarter to be £8,250.

Required:

(a) (i) Calculate the revised corporation tax (CT) payable for the accounting periods ending 31 March 2003

and 2004 respectively. Your answer should include an explanation of the adjustments made as a result

of the information which has now come to light. (7 marks)

(ii) State, giving reasons, the due payment date of the corporation tax (CT) and the filing date of the

corporation tax return for each period, and identify any interest and penalties which may have arisen to

date. (8 marks)

第8题

SUPPLEMENTARY INSTRUCTIONS

1. Calculations and workings need only be made to the nearest RMB.

2. All apportionments should be made to the nearest month.

3. All workings should be shown.

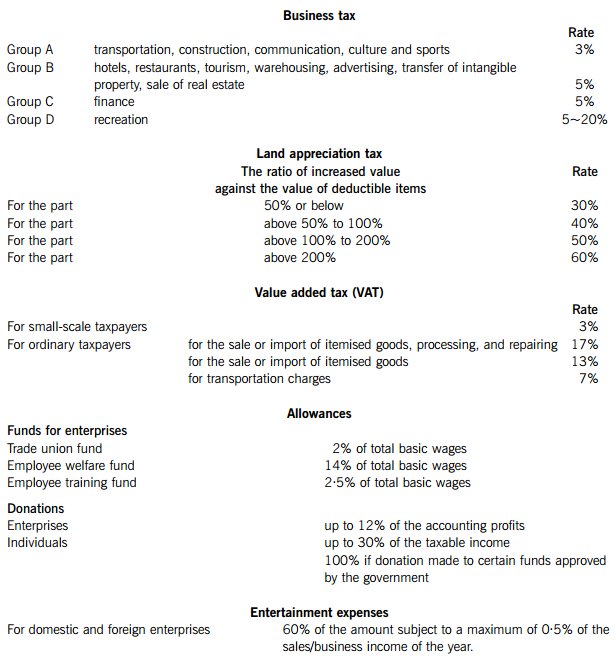

TAX RATES AND ALLOWANCES

The following tax rates and allowances are to be used in answering the questions.

1.

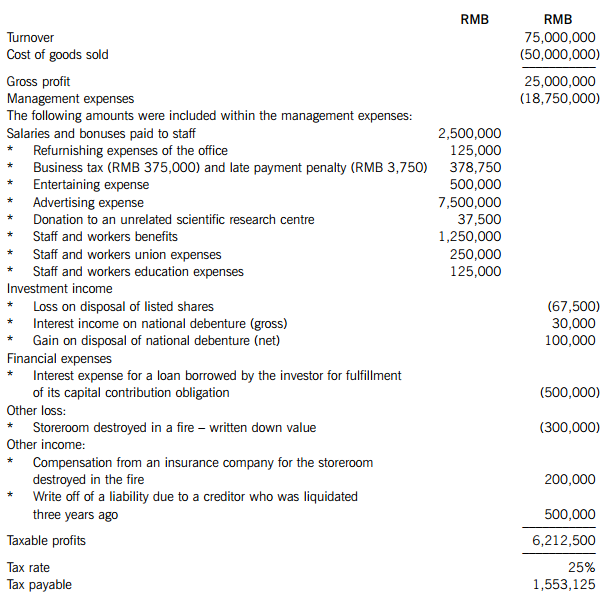

(a) Company L is a manufacturing joint venture enterprise which was established and started operations on 1 January 2010. The statement of enterprise income tax (EIT) payable prepared by the accountant of Company L for the year 2011 is as follows:

Required:

(i) Briefly comment on the correctness of the accountant’s treatment of the 15 items marked with an asterisk (*); (15 marks)

(ii) Calculate the correct amount of enterprise income tax (EIT) payable by Company L for the year 2011. (8 marks)

(b) State under what circumstances a company intending to launch a sales promotion involving the giving of gifts to its individual customers is/is not required to withhold the individual income tax (IIT). (7 marks)

(c) Company L is considering the following two alternatives for launching a sales promotion.

(i) An individual customer will get a gift with a market value equal to RMB100 (cost of purchase RMB80) for free if he/she has accumulated purchases within any single business day of RMB1,000 during the sales promotion period.

(ii) An individual customer will get a gift with a market value equal to RMB200 (cost of purchase RMB100) for free if he/she wins the lottery. A customer will be able to join the lottery for one time when he/she has accumulated purchases within any single business day of RMB1,000 during the sales promotion period.

Required:

Calculate the enterprise income tax (EIT) and individual income tax (IIT), if any, payable for each of the alternatives, assuming that Company L will bear any IIT due.

The following mark allocation is provided as guidance for this requirement:

(i) 2 marks

(ii) 3 marks

2.

(a) Mr Huang, a Chinese national, is the technical officer of Company J. He had the following receipts in the year 2011:

(1) In April, he provided technical services to an enterprise and received RMB 30,000. The related individual income tax was borne by the enterprise.

(2) Mr Huang together with three other people jointly started a partnership with equal shares on 1 October 2011. The profits of the partnership were RMB 300,000 in 2011.

(3) A net gain of RMB 18,000 from trading in the A-shares market.

(4) Euro 10,000 of income received in Country G for the transfer of a patent. Individual income tax equivalent to RMB 15,000 was paid in Country G.

(5) During his visit to Country K, he was invited to give a lecture in a university and was paid income of USD 1,500. Individual income tax equivalent to RMB 1,800 was paid in Country K.

(6) Received RMB 17,000 as insurance compensation.

(7) He won a lottery prize of RMB 30,000, but donated half of this amount to an approved charity.

Required:

Calculate the individual income tax (IIT) payable on each of the items (1) to (7) received by Mr Huang for the year 2011. Clearly state if any of the items of income are exempt from IIT.

Note: the following exchange rates are to be used:

Euro: RMB – 1:9·5

USD: RMB – 1:7 (10 marks)

(b) (i) Briefly explain the individual income tax (IIT) treatment of an annual one-off bonus where the IIT payable is partly borne by the employer as:

(1) a fixed amount; and (1 mark)

(2) a percentage of the IIT payable. (3 marks)

(ii) Company B is considering awarding an annual one-off bonus of RMB 100,000 to its general manager with the IIT being partly borne by the company. The general manager’s normal monthly salary exceeds the monthly deduction.

Required:

Calculate the individual income tax (IIT) payable and the amount to be borne by the general manager (as employee) if:

(1) Company B bears the fixed amount of RMB 20,000 of the total IIT payable by the general manager; and

(2) Company B bears 20% of the total IIT payable by the general manager. (6 marks)

3.

(a) Company M, a coal company, had the following transactions in the month of March 2011:

(1) Bought an excavator for RMB 720,000 plus value added tax (VAT) of RMB 122,400 and paid the related transportation fee of RMB 48,000 (invoice value).

(2) Bought low-value consumption goods for RMB 96,000 plus VAT of RMB 6,720.

(3) Sold 10,000 tons of coal by instalment to a customer for RMB 600 per ton (excluding VAT). One quarter of the payment was due in the month, but only RMB 1,000,000 (excluding VAT) was received. Separately RMB 72,000 was paid for transportation relating to the delivery.

(4) 250 tons of coal was used to provide heating for the staff dormitory and 600 tons of coal was given to customers as gifts.

(5) Sold 150 thousand cubic metres of natural gas acquired while mining for RMB 300,000 (excluding VAT).

Required:

Calculate the value added tax (VAT) liability of Company M for the month of March 2011. (6 marks)

(b) Define ‘Small-scale taxpayer’ for value added tax (VAT) purposes and state how their VAT liability is calculated and the type of VAT invoices they should use. (4 marks)

(c) Company N, a construction company, had the following transactions in the month of March 2011:

(1) Signed a contract with a metal company to build a factory. Partial payment of RMB 9,600,000 was received when the contract was signed. 15% of the building was constructed at the end of the month.

(2) Signed a contract with a country club for laying cables. The contract sum was RMB 1,200,000 which included the value of the cables provided by the country club of RMB 200,000. The job was finished and the money was received before the end of the month.

(3) Signed a contract with a metro company to provide mud engineering services and received RMB 2,000,000.

(4) Signed a contract with a supermarket for decoration services, including labour costs of RMB 450,000, management fees of RMB 50,000 and material costs of RMB200,000. The supermarket provided an additional RMB 150,000 of materials.

(5) Sold a self-constructed house to a member of staff for RMB 1,500,000, plus a gas pipe installation fee of RMB 10,000 and building repair funds of RMB 150,000. The cost of the building construction was RMB 600,000. The profit ratio for the construction as set by the local tax bureau is 20%.

Required:

Calculate the business tax payable by Company N for each of the transactions (1) to (5) relating to the month of March 2011.

(d) State how the tax bureau may assess business tax on service income if it considers the income declared to be too low and without proper justification and list the methods that may be used. (4 marks)

4.

(a) A trading company, Company S, imported some cosmetic goods costing USD 1,680,000. The additional costs of importing these goods were freight and insurance charges of USD 252,000, customs handling fees of USD 140,000 and a service fee to an overseas agent of USD 28,000.

Company S repacked the cosmetic goods into 10,000 sets for sale in China. 9,000 sets were sold to a wholesaler for USD 6,000,000 and 1,000 sets were sold by retail for USD 900,000. Both these sales figures include value added tax (VAT).

Required:

(i) Calculate the consumption tax, customs duty and value added tax (VAT) payable on the importation of the cosmetic goods; (5 marks)

(ii) Calculate the consumption tax and VAT payable on the sale of the cosmetic goods. (5 marks)

Notes:

(1) The customs tariff rate is 40%

(2) The consumption tax rate for cosmetic goods is 30%

(3) The USD:RMB exchange rate is 1:7·5

(b) List the methods by which Customs may assess the dutiable value of an import if it considers the value declared to be too low and without proper justification. (5 marks)

5.

Company C and its overseas branch, Branch D, both started business in 2010. Company C had a taxable loss of RMB 1,000,000 for the year 2010 and income of RMB 3,000,000 for the year 2011, while Branch D had taxable income of RMB 1,000,000 and paid foreign tax of RMB 300,000 for each of the years, 2010 and 2011. Both Company C and Branch D are subject to an income tax rate of 25%.

Required:

(a) In relation to foreign tax paid by a Chinese taxpayer, state the general tax treatment and the limitations on the amount of credit available. (3 marks)

(b) Calculate the enterprise income tax (EIT) payable by Company C for each of the years 2010 and 2011, clearly identifying the foreign tax credit used in each year and the unused tax credit carried forward, if any. (5 marks)

(c) Briefly explain the EIT provisional and annual filing requirements for a domestic registered enterprise with branches registered in different regions in China. (2 marks)

请帮忙给出每个问题的正确答案和分析,谢谢!

第9题

(a) Emcee, a public limited company, is a sports organisation which owns several football and basketball teams. It has a financial year end of 31 May 2016. Emcee needs a new stadium to host sporting events which will be included as part of Emcee’s property, plant and equipment. Emcee therefore commenced construction on a new stadium on 1 February 2016, and this continued until its completion which was after the year end of 31 May 2016. The direct costs were $20 million in February 2016 and then $50 million in each month until the year end. Emcee has not taken out any specific borrowings to finance the construction of the stadium, but it has incurred finance costs on its general borrowings during the period, which could have been avoided if the stadium had not been constructed. Emcee has calculated that the weighted average cost of borrowings for the period 1 February–31 May 2016 on an annualised basis amounted to 9% per annum. Emcee needs advice on how to treat the borrowing costs in its financial statements for the year ending 31 May 2016. (6 marks)

(b) Emcee purchases and sells players’ registrations on a regular basis. Emcee must purchase registrations for that player to play for the club. Player registrations are contractual obligations between the player and Emcee. The costs of acquiring player registrations include transfer fees, league levy fees, and player agents’ fees incurred by the club. Often players’ former clubs are paid amounts which are contingent upon the performance of the player whilst they play for Emcee. For example, if a contracted basketball player scores an average of more than 20 points per game in a season, then an additional $5 million may become payable to his former club. Also, players’ contracts can be extended and this incurs additional costs for Emcee.

At the end of every season, which also is the financial year end of Emcee, the club reviews its playing staff and makes decisions as to whether they wish to sell any players’ registrations. These registrations are actively marketed by circulating other clubs with a list of players’ registrations and their estimated selling price. Players’ registrations are also sold during the season, often with performance conditions attached. Occasionally, it becomes clear that a player will not play for the club again because of, for example, a player sustaining a career threatening injury or being permanently removed from the playing squad for another reason. The playing registrations of certain players were sold after the year end, for total proceeds, net of associated costs, of $25 million. These registrations had a net book value of $7 million.

Emcee would like to know the financial reporting treatment of the acquisition, extension, review and sale of players’ registrations in the circumstances outlined above. (10 marks)

(c) Emcee uses the revaluation model to measure its stadiums. The directors have been offered $100 million from an airline for the property naming rights of all the stadiums for three years. There are two directors who are on the management boards of Emcee and the airline. Additionally, there are regulations in place by both the football and basketball leagues which regulate the financing of the clubs. These regulations prevent capital contributions from a related party which ‘increases equity without repayment in return’. The aim of these regulations is to promote sustainable business models. Sanctions imposed by the regulator include fines and withholding of prize monies. Emcee wishes to know how to take account of the naming rights in the valuation of the stadium and the potential implications of the financial regulations imposed by the leagues. (7 marks)

Required:

Discuss how the above events would be shown in the financial statements of Emcee under International Financial Reporting Standards.

Note: The split of the mark allocation is shown against each of the three issues above.

Professional marks will be awarded in question 3 for clarity and quality of presentation. (2 marks)

第10题

If you're a small business, the chances are that for every $100 you owe, others owe you $155. What's more, you're probably waiting up to 12 weeks to get paid. It's not right. Some business people have very definite ideas about what should be done to make things fairer.

Improving credit control can make a world of difference to your business prospects. Profit is good, but it's cash that pays the wages.

So here are ten tips(提示) to help you get what's due to you.

1. Assess the credit risk of every customer and assign a credit limit to them before any goods are supplied. Trade and bank references should always be taken up before accepting a customer on credit terms.

2. State the credit terms clearly on each invoice(a pay by date and details of interest charges)

3. Ask for a percentage(百分比) of the invoice value in advance as protection against bad debt and to help cash flow.

4. Try credit insurance if credit checks do not come up to standard. It's not always available, but it can provide up to 100 percent cover on approved debts, guaranteeing payment by a specified date.

5. Think about using debt collection agencies for smaller debts. Agency fees, usually based on a percentage, are only payable if the debt is successfully recovered.

6. Investigate the potential of factoring(垫付并代为收账). Factors purchase a firm's unpaid invoices, paying up to 70 percent or more of the face value, but they often only take on the best customers.

7. Make sure you know the names and department of the person to whom each invoice is being sent.

8. Check how long existing customers take to pay—and negotiate new credit terms if they're not meeting bills on time.

9. Offer your customers discounts for paying up promptly when invoiced.

10. Follow up with a fax to make sum your invoice isn't overlooked, disregarded or left at the bottom of the pile.

What sort of people is this article written for?

It aims at ______.

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!

微信搜一搜

微信搜一搜

上学吧

上学吧

微信搜一搜

微信搜一搜

上学吧

上学吧