题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Managing Cash Flow in the everyday sense is about making sure you have money coming in to

If you're a small business, the chances are that for every $100 you owe, others owe you $155. What's more, you're probably waiting up to 12 weeks to get paid. It's not right. Some business people have very definite ideas about what should be done to make things fairer.

Improving credit control can make a world of difference to your business prospects. Profit is good, but it's cash that pays the wages.

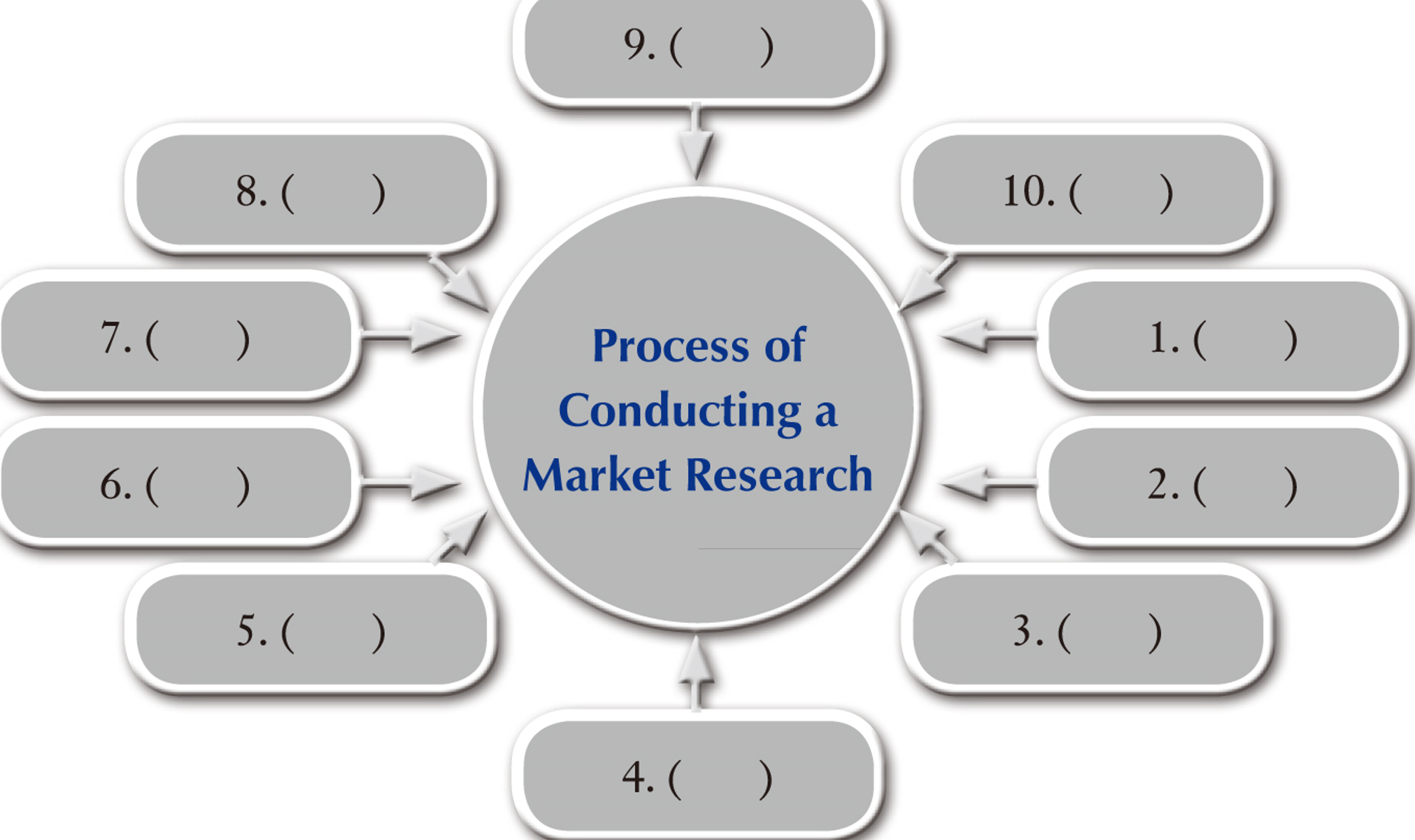

So here are ten tips(提示) to help you get what's due to you.

1. Assess the credit risk of every customer and assign a credit limit to them before any goods are supplied. Trade and bank references should always be taken up before accepting a customer on credit terms.

2. State the credit terms clearly on each invoice(a pay by date and details of interest charges)

3. Ask for a percentage(百分比) of the invoice value in advance as protection against bad debt and to help cash flow.

4. Try credit insurance if credit checks do not come up to standard. It's not always available, but it can provide up to 100 percent cover on approved debts, guaranteeing payment by a specified date.

5. Think about using debt collection agencies for smaller debts. Agency fees, usually based on a percentage, are only payable if the debt is successfully recovered.

6. Investigate the potential of factoring(垫付并代为收账). Factors purchase a firm's unpaid invoices, paying up to 70 percent or more of the face value, but they often only take on the best customers.

7. Make sure you know the names and department of the person to whom each invoice is being sent.

8. Check how long existing customers take to pay—and negotiate new credit terms if they're not meeting bills on time.

9. Offer your customers discounts for paying up promptly when invoiced.

10. Follow up with a fax to make sum your invoice isn't overlooked, disregarded or left at the bottom of the pile.

What sort of people is this article written for?

It aims at ______.

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案