题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

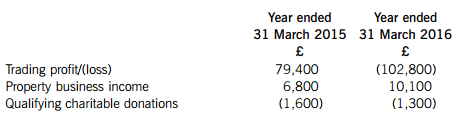

Rajesh is a sole trader. He correctly calculated his self-assessment payments on account f

Rajesh paid the correct balancing payment of £1,200 for the tax year 2015–16 on 30 June 2017.

What penalties and interest may Rajesh be charged as a result of his late balancing payment for the tax year 2015–16?

A.Interest of £15 only

B.Interest of £36 only

C.Interest of £36 and a penalty of £60

D.Interest of £15 and a penalty of £60

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案