题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

(a) Two of the qualitative characteristics of information contained in the IASB’s Conceptu

(a) Two of the qualitative characteristics of information contained in the IASB’s Conceptual Framework for Financial Reporting are understandability and comparability

Required:

Explain the meaning and purpose of the above characteristics in the context of financial reporting and discuss the role of consistency within the characteristic of comparability in relation to changes in accounting policy. (6 marks)

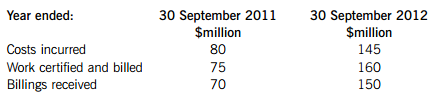

(b) Lobden is a construction contract company involved in building commercial properties. Its current policy for determining the percentage of completion of its contracts is based on the proportion of cost incurred to date compared to the total expected cost of the contract.

One of Lobden’s contracts has an agreed price of $250 million and estimated total costs of $200 million.

The cumulative progress of this contract is:

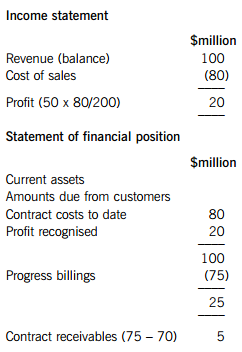

Based on the above, Lobden prepared and published its financial statements for the year ended 30 September 2011. Relevant extracts are:

Lobden has received some adverse publicity in the financial press for taking its profit too early in the contract process, leading to disappointing profits in the later stages of contracts. Most of Lobden’s competitors take profit based on the percentage of completion as determined by the work certified compared to the contract price.

Required:

(i) Assuming Lobden changes its method of determining the percentage of completion of contracts to that used by its competitors, and that this would represent a change in an accounting estimate, calculate equivalent extracts to the above for the year ended 30 September 2012; (7 marks)

(ii) Explain why the above represents a change in accounting estimate rather than a change in accounting policy. (2 marks)

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案