题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

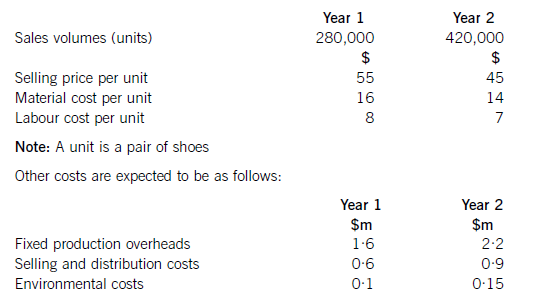

The Accountancy Teaching Co (AT Co) is a company specialising in the provision of accounta

The Accountancy Teaching Co (AT Co) is a company specialising in the provision of accountancy tuition courses in the private sector. It makes up its accounts to 30 November each year. In the year ending 30 November 2009, it held 60% of market share. However, over the last twelve months, the accountancy tuition market in general has faced a 20% decline in demand for accountancy training leading to smaller class sizes on courses. In 2009 and before, AT Co suffered from an ongoing problem with staff retention, which had a knock-on effect on the quality of service provided to students. Following the completion of developments that have been ongoing for some time, in 2010 the company was able to offer a far-improved service to students. The developments included:

– A new dedicated 24 hour student helpline

– An interactive website providing instant support to students

– A new training programme for staff

– An electronic student enrolment system

– An electronic marking system for the marking of students’ progress tests. The costs of marking electronically were expected to be $4 million less in 2010 than marking on paper. Marking expenditure is always included in cost of sales

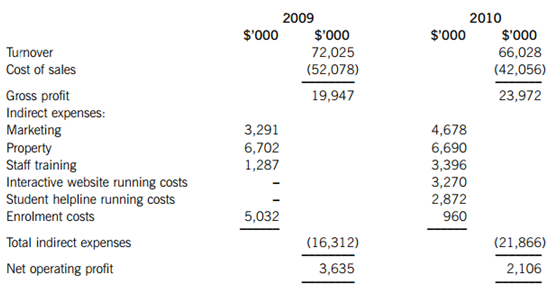

Extracts from the management accounts for 2009 and 2010 are shown below:

On 1 December 2009, management asked all ‘freelance lecturers’ to reduce their fees by at least 10% with immediate effect (‘freelance lecturers’ are not employees of the company but are used to teach students when there are not enough of AT Co’s own lecturers to meet tuition needs). All employees were also told that they would not receive a pay rise for at least one year. Total lecture staff costs (including freelance lecturers) were $41·663 million in 2009 and were included in cost of sales, as is always the case. Freelance lecturer costs represented 35% of these total lecture staff costs. In 2010 freelance lecture costs were $12·394 million. No reduction was made to course prices in the year and the mix of trainees studying for the different qualifications remained the same. The same type and number of courses were run in both 2009 and 2010 and the percentage of these courses that was run by freelance lecturers as opposed to employed staff also remained the same.

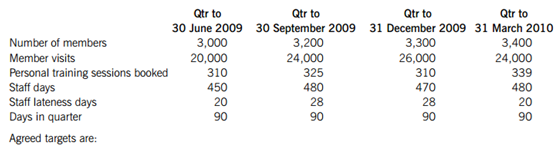

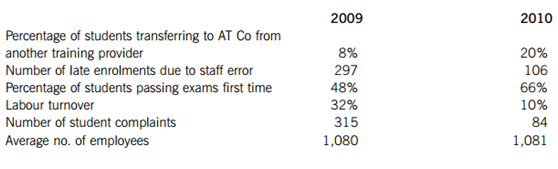

Due to the nature of the business, non-financial performance indicators are also used to assess performance, as detailed below.

Required:

Assess the performance of the business in 2010 using both financial performance indicators calculated from the above information AND the non-financial performance indicators provided.

NOTE: Clearly state any assumptions and show all workings clearly. Your answer should be structured around the following main headings: turnover; cost of sales; gross profit; indirect expenses; net operating profit. However, in discussing each of these areas you should also refer to the non-financial performance indicators, where relevant.

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案