证券交易员试题模拟

进场点:好的进场点将使你立于不败之地,一个优秀的交易员,只要能把开仓点做好,做到极致,错单少,就一定能持续盈利,交易过程的其它问题都不是问题。一个优秀的进场点需要包括:1.极致的盈亏比:风险可控,盈利无限;2.最少的假信号:过滤噪声,优化效率。

[单选题]

If a 7.5% coupon bond is trading for $1050.00, it has a current yield of()percent.

A .7.0B .7.4C .7.1D .6.9

[单选题]

A coupon bond pays annual interest, has a par value of $1,000, matures in 4 years, has a coupon rate of 10%, and has a yield to maturity of 12%.The current yield on this bond is().

A .10.65%B .10.45%C .10.95%D .10.52%

[单选题]

To earn a high rating from the bond rating agencies, a firm should have().

A .a low times interest earned ratioB .a low debt to equity ratioC .a high quick ratioD .B and C

[单选题]

In the mean-standard deviation graph an indifference curve has a()slope.()

A .negativeB .zeroC .positiveD .northeast

[单选题]

A fair game()

A .will not be undertaken by a risk-averse investor.B .is a risky investment with a zero risk premium.C .is a risk less investment.D .Both A and B are true.E .Both A and C are true.

[单选题]

The utility score an investor assigns to a particular portfolio, other things equal,()

A .will decrease as the rate of return increases.B .will decrease as the standard deviation increases.C .will decrease as the variance increases.D .will increase as the variance increases.E .will increase as the rate of return increases.

[单选题]

According to the mean-variance criterion, which of the statements below is correct?()

A .Investment B dominates Investment A.B .Investment B dominates Investment C.C .Investment D dominates all of the other investments.D .Investment D dominates only Investment B.E .Investment C dominates investment A.

[单选题]

What would be the dollar value of your positions in X, Y, and the T-bills,respectively, if you decide to hold a portfolio that has an expected outcome of $1,200?()

A .Cannot be determinedB .$54; $568; $378C .$568; $54; $378D .$378; $54; $568E .$108; $514; $378

[单选题]

Asset allocation()

A .may involve the decision as to the allocation between a risk-free asset and a risky asset.B .may involve the decision as to the allocation among different risky assets.C .may involve considerable security analysis.D .A and B.E .A and C.

[主观题]

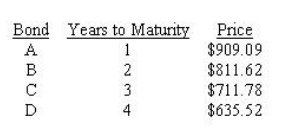

Consider the following $1,000 par value zero-coupon bonds:

44.The yield to maturity on bond A is().

A)10%

B)11%

C)12%

D)14%

E)none of the above

45.The yield to maturity on bond B is().

A)10%

B)11%

C)12%

D)14%

E)none of the above

46.The yield to maturity on bond C is().

A)10%

B)11%

C)12%

D)14%

E)none of the above

47.The yield to maturity on bond D is().

A)10%

B)11%

C)12%

D)14%

E)none of the above

[单选题]

A bond will sell at a discount when().

A .the coupon rate is greater than the current yield and the current yield is greater than yield to maturityB .the coupon rate is greater than yield to maturityC .the coupon rate is less than the current yield and the current yield is greater than the yield to maturityD .the coupon rate is less than the current yield and the current yield is less than yield to maturityE .none of the above is true.

[单选题]

Bearer bonds are()

A .bonds traded without any record of ownership.B .helpful to tax authorities in the enforcement of tax collection.C .rare in the United States today.D .all of the above.E .both A and C.

[单选题]

TIPS are()

A .securities formed from the coupon payments only of government bonds.B .securities formed from the principal payments only of government bonds.C .government bonds with par value linked to the general level of prices.D .government bonds with coupon rate linked to the general level of prices.E .zero-coupon government bonds.

[单选题]

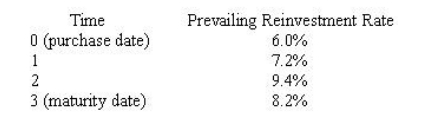

Three years ago you purchased a bond for $974.69. The bond had three years

to maturity, a coupon rate of 8%, paid annually, and a face value of $1,000. Each year you

reinvested all coupon interest at the prevailing reinvestment rate shown in the table below.

Today is the bond's maturity date. What is your realized compound yield on the bond?()

A .6.43%B .7.96%C .8.23%D .8.97%E .9.13%

[单选题]

In rigorous probability theory,().

A .all the subsets of the sample space Ω can always be considered events.B .only the subsets of Ω that belong to a certain sigma-algebra (the space of events) can be considered events.C .only the subsets of Ω that have probability strictly greater than zero can be considered events.D .only the subsets of Ω whose complements have probability strictly greater than zero can be considered events.

[单选题]

A relative value hedge fund manager holds a long position in Asset A and a short position in asset B of roughly equal principal amounts. Asset A currently has a correlation with asset B of 0.97. The risk manager decides to overwrite this correlation assumption in the variance covariance based VAR model to a level of 0.30. What effect will this change have on the resulting VAR measure?()

A .It increases VAR.B .It decreases VAR.C .It has no effect on VAR, but changes profit or loss of strategy.D .Do not have enough information to answer.

[单选题]

A credit default swap is an instrument that can be characterized best as: ().

A .Any swap that has one or more parties in defaultB .A swap that can only be valued against non–investmentgrade debt securitiesC .An option to sell defaulted securities at par value to a third party in exchange for a series of fixed cash flowsD .Any swap that defaults to a thirdparty guarantor should a party to the swap file for bankruptcy protection

[单选题]

A portfolio consists of one (long) $100 million asset and a default protection contract on this asset. The probability of default over the next year is 10% for the asset and 20%for the counter party that wrote the default protection. The joint probability of default for the asset and the contract counter party is 3%. Estimate the expected loss on this portfolio due to credit defaults over the next year with a 40% recovery rate on the asset and 0% recovery rate for the counter party.()

A .$3.0 millionB .$2.2 millionC .$1.8 millionD .None of the above

[单选题]

Which of the following best reflects an operational risk faced by a bank?()

A .A counter party invokes force majeure on a swap contract.B .The Federal Reserve unexpectedly cuts interest rates by 100 bps.C .A power outage shuts down the trading floor indefinitely with no backup facility.D .The rating agencies downgrade the sovereign debt of the bank’s sovereign counter party.

[单选题]

The failure of Barings Bank is a typical example of a lack in control pertaining to which one of the following risks: ().

A .Liquidity riskB .Credit riskC .Operational riskD .Foreign exchange risk