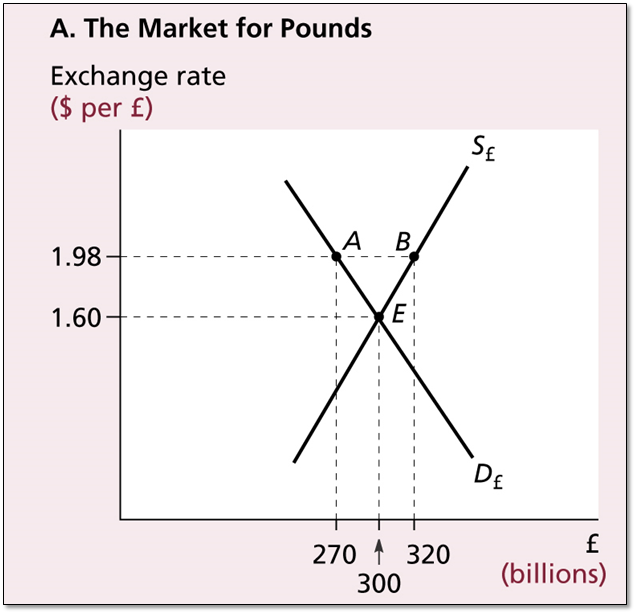

In Figure 3. 2 A (在图表3.2 A中), consider an offi...

In Figure 3. 2 A (在图表3.2 A中), consider an officially declared “par value” is $2.00 per pound(假设官方宣布的“平价”汇率为每英镑2美元), its market-clearing rate is$1.60 per pound(英镑的市场出清价格1.6美元). British officials have announced that they will support the pound at 1 percent below par(about $1.98)and the dollar at 1 percent above par(about $2.02)(英国官方已宣布其将在平价的1%以下(约为1.98美元)支持英镑,在平价的1%以上(约为2.02美元)支持美元). In Figure 3.2A, the official are forced to make good on this pledge by officially intervening in the foreign exchange market: buying £50 billion, and ()(政府当局被迫通过对外汇市场的干预来履行这一承诺具体做法是在外汇市场中买入500亿英镑, 同时())。

A、buying $99 billion (equal to £ 50 billion times $1. 98 per pound)

B、selling $99 billion (equal to £ 50 billion times $1. 98 per pound)

C、buying 50 billion dollars

D、selling 50 billion dollars

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案