题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

1988年7月巴塞尔银行监管委员会发布的《巴塞尔协议》,其内容就是确认了监管银行( )的可行的统一标准。

A.存款

B.贷款

C.资产

D.资本

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.存款

B.贷款

C.资产

D.资本

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

更多“1988年7月巴塞尔银行监管委员会发布的《巴塞尔协议》,其内…”相关的问题

更多“1988年7月巴塞尔银行监管委员会发布的《巴塞尔协议》,其内…”相关的问题

第1题

Holding a group of assets reduces risk as long as the assets______.

A.are perfectly correlated

B.are completely independent

C.have a correlation coefficient greater than one

D.do not have precisely the same pattern of returns

第2题

A.reduces; increases

B.increases; reduces

C.reduces; reduces

D.increases; increases

第4题

A.reduces; increases

B.increases; reduces

C.reduces; reduces

D.increases; increases

第5题

第6题

A、Assessment of repayment ability of an entity

B、Measuring performance, risk and return

C、Taking decisions regarding holding investments

D、Taking buy/sell decisions

第7题

Types of risks

So far we have used the term "risk" rather loosely. One type of risk is default risk, that is, the risk that the borrower will simply not repay the loan, due to either dishonesty or plain inability to do so. Another type of risk, called purchasing - power risk, is the risk that, due to an unexpectedly high inflation rate, the future interest payments, and the principal of the loan when finally repaid, will have less purchasing power than the lender anticipated at the time the loan was made. A similar risk is faced by borrowers. A borrower may cheerfully agree to pay, say, 15 percent interest, expecting that a 12 percent inflation rate will reduce the real value of the loan. But inflation may be only 4 percent.

A third type of risk is called "interest - rate risk" or "market risk", that is, the risk that the market value of a security will fall because interest rates will rise. We will discuss this further later; here we just present the intuitive idea. Suppose that five years ago you bought a ten-year 1 000 bond carrying a 6 percent interest rate, and tile interest rate now obtainable on similar bonds also have five years to go until they mature is 8 percent. Would anyone pay 1 000 for your bond? Surely not, because they could earn 80 per year by buying a new bond, and only 60 per year by buying your bond. Hence, to sell your bond you would have to reduce its price. But suppose the bond, instead of having five years to maturity, would mature in, say, ninety days, what would its price be then? It would still be less than 1 000 since the buyer would get 6 percent instead of 8 percent interest for ninety days; but since getting a lower interest sell for only ninety days does not involve much of a loss, the bond would sell for something close to 1 000. Hence, while holding any security with a fixed interest rate involves some interest - rate risk, the closer to maturity a security is, the lower is this risk. On the other hand, if interest rates fall you gain because your bond is worth more; and the longer the time until the bond matures, the greater is your gain. But the fact that you may gain as well as lose does not mean that you are taking no risk.

Diversification

All three types of risks are relevant for deciding what assets to include in a portfolio, and what debts to have outstanding. (The term portfolio means the collection of assets one owns.) Anyone holding more than one type of asset has to consider not the risk of each asset taken by itself, but the totality of the risk on various assets and debts jointly. Suppose someone holds stock in a company that is likely to gain from inflation. The riskiness of a portfolio that combines both of these stocks may be less than the riskiness of each stock taken separately. A port- folio consisting of assets that are affected in opposite directions by given future events is less risky than are the assets that compose it when taken individually. Hence a low-risk portfolio need not contain only assets that individually have little risk; sometimes one reduces the riskiness of a portfolio by adding some high - risk assets that offset the risks of other assets in it.

For Paragraph 1 choose the summary which you think best expresses the main idea.

A.The existence of inflation produces purchasing - power risk.

B.Purchasing - power risk involves a loss in the value of money loaned or borrowed be- cause of higher or lower inflation than expected.

C.Purchasing - power risk produced by an inflation higher than expected affects lenders only.

第8题

A、risk relative to other assets

B、expected return relative to other assets

C、liquidity relative to other assets

D、wealth

第9题

A、the risk of all assets is the same.

B、the time to maturity for all assets is the same.

C、the coupon rate of all assets is the same.

D、the market value of assets is the same. .

第10题

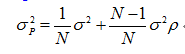

Considering a simple portfolio investment strategy: holding N risky assets that have identical expected returns, E(r), and standard deviations, σ, and putting 1/N of your money in each. Assume that the correlation coefficients of all pairs are ρ. Denote the standard deviation of each asset and the portfolio are σ and σP, respectively. The variance of the portfolio can be expressed as Which of the following statements is correct?

Which of the following statements is correct?

A、The first part of the expression represents the non-diversifiable risk

B、The second part of the expression represents the non-diversifiable risk

C、If ρ=1, all risk can be diversified

D、If ρ=-1, all risk can be diversified

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!

微信搜一搜

微信搜一搜

上学吧

上学吧

微信搜一搜

微信搜一搜

上学吧

上学吧