题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

The shipping date is expected to be announced soon.

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

更多“The shipping date is expected …”相关的问题

更多“The shipping date is expected …”相关的问题

第1题

Section B – ALL THREE questions are compulsory and MUST be attempted

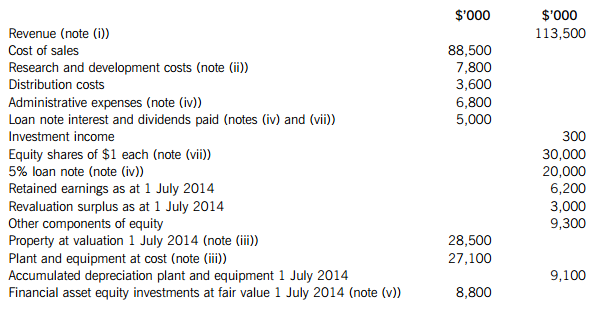

The following trial balance extracts (i.e. it is not a complete trial balance) relate to Moston as at 30 June 2015:

The following notes are relevant:

(i) Revenue includes a $3 million sale made on 1 January 2015 of maturing goods which are not biological assets. The carrying amount of these goods at the date of sale was $2 million. Moston is still in possession of the goods (but they have not been included in the inventory count) and has an unexercised option to repurchase them at any time in the next three years. In three years’ time the goods are expected to be worth $5 million. The repurchase price will be the original selling price plus interest at 10% per annum from the date of sale to the date of repurchase.

(ii) Moston commenced a research and development project on 1 January 2015. It spent $1 million per month on research until 31 March 2015, at which date the project passed into the development stage. From this date it spent $1·6 million per month until the year end (30 June 2015), at which date development was completed. However, it was not until 1 May 2015 that the directors of Moston were confident that the new product would be a commercial success.

Expensed research and development costs should be charged to cost of sales.

(iii) Non-current assets:

Moston’s property is carried at fair value which at 30 June 2015 was $29 million. The remaining life of the property at the beginning of the year (1 July 2014) was 15 years. Moston does not make an annual transfer to retained earnings in respect of the revaluation surplus. Ignore deferred tax on the revaluation.

Plant and equipment is depreciated at 15% per annum using the reducing balance method.

No depreciation has yet been charged on any non-current asset for the year ended 30 June 2015. All depreciation is charged to cost of sales.

(iv) The 5% loan note was issued on 1 July 2014 at its nominal value of $20 million incurring direct issue costs of $500,000 which have been charged to administrative expenses. The loan note will be redeemed after three years at a premium which gives the loan note an effective finance cost of 8% per annum. Annual interest was paid on 30 June 2015.

(v) At 30 June 2015, the financial asset equity investments had a fair value of $9·6 million. There were no acquisitions or disposals of these investments during the year.

(vi) A provision for current tax for the year ended 30 June 2015 of $1·2 million is required, together with an increase to the deferred tax provision to be charged to profit or loss of $800,000.

(vii) Moston paid a dividend of 20 cents per share on 30 March 2015, which was followed the day after by an issue of 10 million equity shares at their full market value of $1·70. The share premium on the issue was recorded in other components of equity.

Required:

(a) Prepare the statement of profit or loss and other comprehensive income for Moston for the year ended 30 June 2015. (11 marks)

(b) Prepare the statement of changes in equity for Moston for the year ended 30 June 2015. (4 marks)

Note: The statement of financial position and notes to the financial statements are NOT required.

第2题

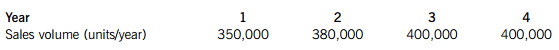

The new machine will incur fixed annual maintenance costs of $145,000 per year. Variable costs are expected to be $3·00 per unit and selling price is expected to be $5·65 per unit. These costs and selling price estimates are in current price terms and do not take account of general inflation, which is forecast to be 4·7% per year.

It is expected that the new machine will need replacing in four years’ time due to advances in technology. The resale value of the new machine is expected to be $200,000 at that time, in future value terms.

The purchase price of the new machine is payable at the start of the first year of the four-year life of the machine. Working capital investment of $150,000 will already exist at the start of the four-year period, due to the operation of the existing machine. This investment in working capital is expected to increase in nominal terms in line with the general rate of inflation.

Argnil Co pays corporation tax one year in arrears at an annual rate of 27% and can claim 25% reducing balance tax-allowable depreciation on the purchase price of the new machine. The company has a real after-tax weighted average cost of capital of 6% and a nominal after-tax weighted average cost of capital of 11%.

Required:

(a) Using a nominal terms net present value approach, evaluate whether purchasing the new machine is financially acceptable. (10 marks)

(b) Discuss the reasons why investment finance may be limited, even when a company has attractive investment opportunities available to it. (5 marks)

第3题

&8226;Which (A, B, C, D or E) does each statement 1-8 refer to?

&8226;For each statement 1-8, mark one letter (A, B, C, D or E) on your Answer Sheet.

&8226;You will need to use some of these letters more than once.

A Sight Bill of Exchange

A sight B/E is usually defined as A bill which is expressed to be payable on demand, or at sight, or on presentation; and a bill in which no time for payment is expressed.

In other words, a sight B/E is the B/E that is payable at once the moment the B/E is presented to the drawee of it. A sight B/E is used in the case where the exporter wants to sell goods to the importer for immediate payment. When a sight B/E is presented to the drawee, the presentation will itself trigger the settlement process unless the B/E is dishonoured.

B Usance Bill of Exchange

A usance B/E is the one that is payable at a stipulated period of time after sight or after date. The date on which the drawee/acceptor sights the B/E is considered as the date on which the B/E is accepted. The acceptor adds the date to his acceptance. In this way the date of payments is fixed. The date on which payment should be effected is called maturity date of the B/E. So a B/E that is payable at 60 days is not a sight B/E but a usance B/E.

C Clean Bill of Exchange

A clean B/E is the one that is not accompanied by any commercial documents, especially not accompanied by the shipping documents. The drawer of a clean B/E may be a business, an individual, or a bank. The payee may be a business, an individual, or a bank.

In international trade, a clean B/E is usually used where the export is not of goods but of a service or used in respect of commission, the remainder of the payment and so on. A clean B/E is used where no shipment is involved or where the shipping documents have for some reason been sent separately to the buyer.

D Documentary Bill of Exchange

A documentary B/E is the one that is accompanied by commercial documents like the invoice, B/L, and insurance policy. When a documentary B/E is presented to the drawee for payment or for acceptance, the drawee will not effect the payment or acceptance unless the shipping documents are also presented to him.

A documentary B/E is welcomed by both the importer and the exporter because both can have more security.

E Commercial Bill of Exchange

The drawer of a commercial B/E may be a business or an individual and the payer may be a business, an individual or a bank. In international payments, the drawer of a commercial B/E is normally the exporter, who draws a B/E for the purpose of getting payment for the goods he sells. A commercial B/E is usually accompanied by shipping documents.

The shipping documents must be presented; otherwise the drawee will not make payment or accept the draft.

第4题

Most advertising is【C11】______to promote the sale of a particular product or service. Some advertisements,【C12】______, are intended to promote an idea or influence behavior, such as【C13】______people not to use illegal drugs or smoke cigarettes. These ads are often called public【C14】______ads. Some ads promote an institution, such as the Red Cross or the United States Army, and are known【C15】______institutional advertising. Their【C16】______is to encourage people to volunteer or donate money or services or【C17】______to improve the image of the institution doing the advertising. Advertising is also Used to promote political parties and【C18】______for political office.【C19】______advertising has become a key component of electoral【C20】______in many countries.

【C1】

A.elevate

B.advance

C.raise

D.promote

第5题

Lockfine, a public limited company, operates in the fishing industry and has recently made the transition to International Financial Reporting Standards (IFRS). Lockfine’s reporting date is 30 April 2011.

(a) In the IFRS opening statement of financial position at 1 May 2009, Lockfine elected to measure its fishing fleet at fair value and use that fair value as deemed cost in accordance with IFRS 1 First Time Adoption of International Financial Reporting Standards. The fair value was an estimate based on valuations provided by two independent selling agents, both of whom provided a range of values within which the valuation might be considered acceptable. Lockfine calculated fair value at the average of the highest amounts in the two ranges provided. One of the agents’ valuations was not supported by any description of the method adopted or the assumptions underlying the calculation. Valuations were principally based on discussions with various potential buyers. Lockfine wished to know the principles behind the use of deemed cost and whether agents’ estimates were a reliable form. of evidence on which to base the fair value calculation of tangible assets to be then adopted as deemed cost. (6 marks)

(b) Lockfine was unsure as to whether it could elect to apply IFRS 3 Business Combinations retrospectively to past business combinations on a selective basis, because there was no purchase price allocation available for certain business combinations in its opening IFRS statement of financial position.

As a result of a major business combination, fishing rights of that combination were included as part of goodwill. The rights could not be recognised as a separately identifiable intangible asset at acquisition under the local GAAP because a reliable value was unobtainable for the rights. The fishing rights operated for a specified period of time.

On transition from local GAAP to IFRS, the fishing rights were included in goodwill and not separately identified because they did not meet the qualifying criteria set out in IFRS 1, even though it was known that the fishing rights had a finite life and would be fully impaired or amortised over the period specified by the rights. Lockfine wished to amortise the fishing rights over their useful life and calculate any impairment of goodwill as two separate calculations. (6 marks)

(c) Lockfine has internally developed intangible assets comprising the capitalised expenses of the acquisition and production of electronic map data which indicates the main fishing grounds in the world. The intangible assets generate revenue for the company in their use by the fishing fleet and are a material asset in the statement of financial position. Lockfine had constructed a database of the electronic maps. The costs incurred in bringing the information about a certain region of the world to a higher standard of performance are capitalised. The costs related to maintaining the information about a certain region at that same standard of performance are expensed. Lockfine’s accounting policy states that intangible assets are valued at historical cost. The company considers the database to have an indefinite useful life which is reconsidered annually when it is tested for impairment. The reasons supporting the assessment of an indefinite useful life were not disclosed in the financial statements and neither did the company disclose how it satisfied the criteria for recognising an intangible asset arising from development.

(d) The Lockfine board has agreed two restructuring projects during the year to 30 April 2011:

Plan A involves selling 50% of its off-shore fleet in one year’s time. Additionally, the plan is to make 40% of its seamen redundant. Lockfine will carry out further analysis before deciding which of its fleets and related employees will be affected. In previous announcements to the public, Lockfine has suggested that it may restructure the off-shore fleet in the future.

Plan B involves the reorganisation of the headquarters in 18 months time, and includes the redundancy of 20% of the headquarters’ workforce. The company has made announcements before the year end but there was a three month consultation period which ended just after the year end, whereby Lockfine was negotiating with employee representatives. Thus individual employees had not been notified by the year end. Lockfine proposes recognising a provision in respect of Plan A but not Plan B. (5 marks)

Professional marks will be awarded in question 2 for clarity and quality of discussion. (2 marks)

Required:

Discuss the principles and practices to be used by Lockfine in accounting for the above valuation and recognition issues.

第6题

To: Emily Rhodes

Subject: Shipping Conference

Date: August 11

Dear Ms. Rhodes,

I am emailing to update you on the preparations for the 4th Annual Shipping Conference that your organization asked me to handle. (84) the arrangements are in order, including speaker and guest invitations, event marketing, and media publicity.

Although the planning is nearly complete, there is one issue that concerns me. That is the venue for the event. You previously indicated a strong preference for holding the event at the Spencer Hotel in Wyford. Unfortunately, the west wing of the hotel is currently being renovated. I'm worried that there may not be (85) space in the hotel to accommodate all of the out-of-town attendees.

Accordingly, I think it would be best to consider alternative venues for the event. I would be happy (86) the options and present you with a list of possibilities. I hope this solution is acceptable to you. Kind regards,

Keith Rogers

Director, Bright Conferences

(44)

A.Some

B.Almost

C.Little of

D.Most of

第7题

(A) The reporter asked the questions.

(B) The clerk is making five copies.

(C) The copyright date is 2003.

(38)

A.

B.

C.

第8题

A. from 10th to 20th

B. from 5th to 15th

C. from 1st to 10th

D. from 1st to 15th

第9题

If not actual date of dispatch is required by the credit to be shown on the document,the date ofissuance of an air transport document will be deemed to be the date of dispatch,even if the documentshows a flight date and/or a flight number in the box marked“for Carrier Use Only”or similarexpression. If the actual flight date is shown as a separate notation, but is not required by the credit,it will be disregarded in determining the date of shipment.

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!

微信搜一搜

微信搜一搜

上学吧

上学吧

微信搜一搜

微信搜一搜

上学吧

上学吧