题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A company with gross profit of £67,000 has a sales figure of £521,000. What is the company’s gross profit margin?

A.12.86%

B.7.77%

C.34%

D.87%

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.12.86%

B.7.77%

C.34%

D.87%

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

更多“A company with gross profit of…”相关的问题

更多“A company with gross profit of…”相关的问题

第1题

A. liabilities when calculating the company’s current ratio.

B. equity when calculating the company’s return on equity ratio.

C. liabilities when calculating the company’s debt-to-equity ratio.

第2题

1 Unrealised revaluation gains.

2 Dividends paid.

3 Proceeds of equity share issue.

4 Profit for the period.

A 2, 3 and 4 only

B 1, 3 and 4 only

C All four items

D 1, 2 and 4 only

第3题

Choose the best word to fill each gap from A, B, C or D on the opposite page.

Another successful year

The UK-based agricultural and garden equipment group PLT has had another successful year and is looking forward to the future with. The group, which also has distribution and fuel (19) has enjoyed record profits for the fifth year in a (20) Pre-tax profits for the year (21) March 31 rose by 24 per cent to £4.2 million. Total group sales (22) by five per cent to £155 million, with the agricultural business delivering yet another record (23) despite the somewhat difficult trading (24) in the industry. Sales in the garden equipment (25) were slow in the early months of the year, but increased dramatically in the final quarter.

Chairman Suresh Kumar said, 'It is my (26) that we have continued to grow by (27) our customers well. I am delighted to (28) the continued development of our customer (29) and I would like to thank all our customers for their (30) As well as an increase in customers, our staff numbers also continue to grow. During the year, we have taken (31) 58 new employees, so that our total workforce now numbers in excess of 700. All of the staff deserve my praise for their dedication and continued efforts in (32) these excellent results.' The group has proposed a final (33) of 9.4p per share, bringing the total to 13p for the year.

(19)

A.commitments

B.interests

C.responsibilities

D.benefits

第4题

A.include it in equity.

B.include it in liabilities.

C.not include it in either equity or liabilities.

第5题

1. Calculations and workings need only be made to the nearest £.

2. All apportionments should be made to the nearest month.

3. All workings should be shown.

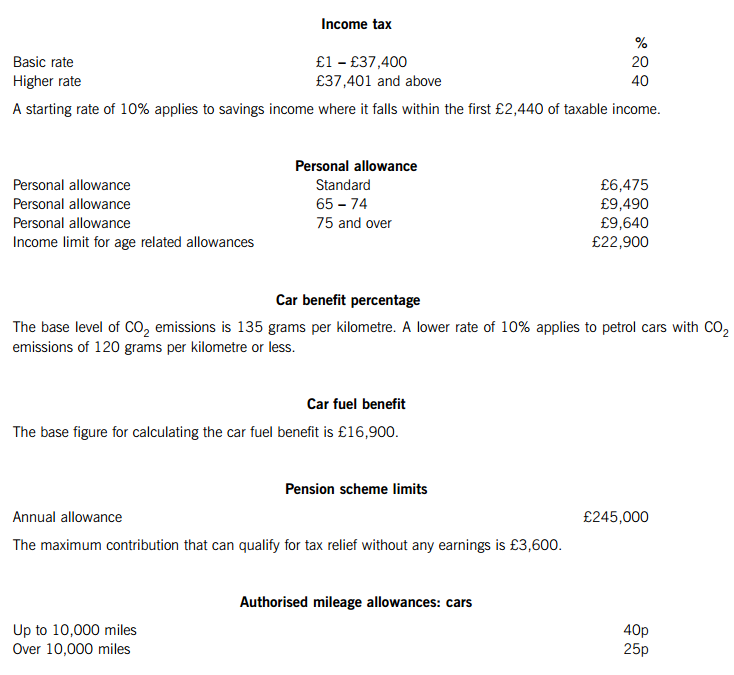

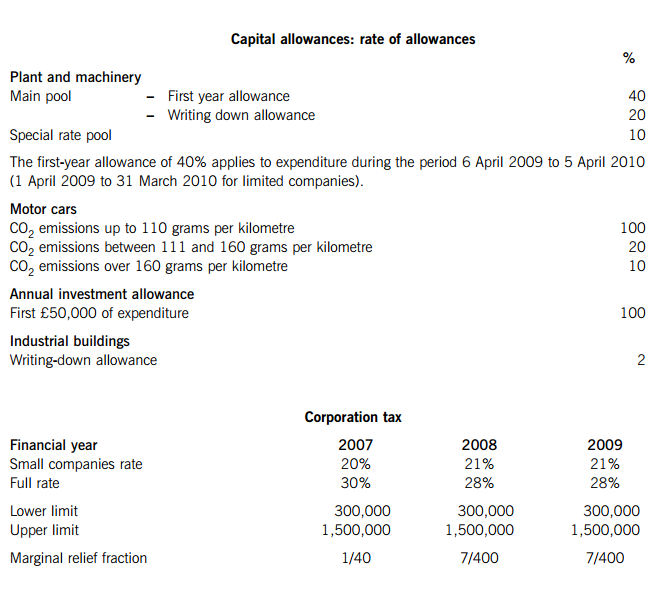

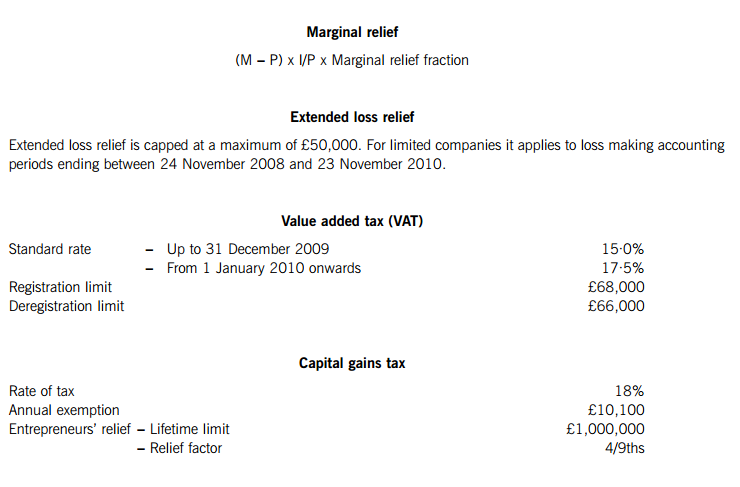

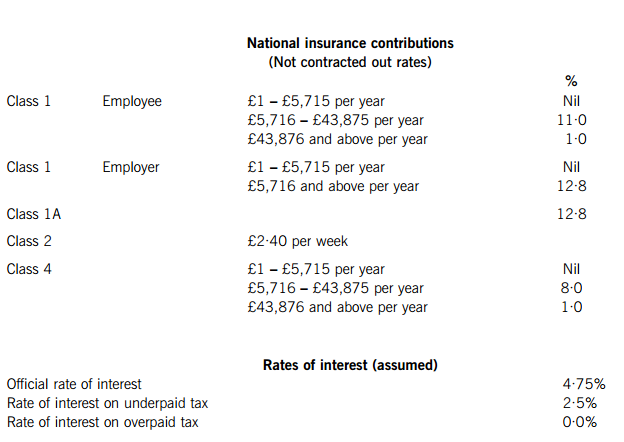

TAX RATES AND ALLOWANCES

The following tax rates and allowances are to be used in answering the questions.

ALL FIVE questions are compulsory and MUST be attempted

1.Auy Man and Bim Men have been in partnership since 6 April 2000 as management consultants. The following information is available for the tax year 2009–10:

Personal information

Auy is aged 32. During the tax year 2009–10 she spent 190 days in the United Kingdom. Bim is aged 56. During the tax year 2009–10 she spent 100 days in the United Kingdom. Bim has spent the same amount of time in the United Kingdom for each of the previous five tax years.

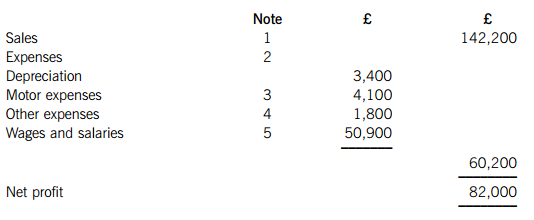

Profit and loss account for the year ended 5 April 2010

The partnership’s summarised profit and loss account for the year ended 5 April 2010 is as follows:

(1) The sales figure of £142,200 is exclusive of output value added tax (VAT) of £21,600.

(2) The expenses figures are exclusive of recoverable input VAT of:

Motor expenses £180

Other expenses £140

(3) The figure of £4,100 for motor expenses includes £2,600 in respect of the partners’ motor cars, with 30% of this amount being in respect of private journeys.

(4) The figure of £1,800 for other expenses includes £720 for entertaining employees. The remaining expenses are all allowable.

(5) The figure of £50,900 for wages and salaries includes the annual salary of £4,000 paid to Bim (see the profit sharing note below), and the annual salary of £15,000 paid to Auy’s husband, who works part-time for the partnership. Another part-time employee doing the same job is paid a salary of £10,000 per annum.

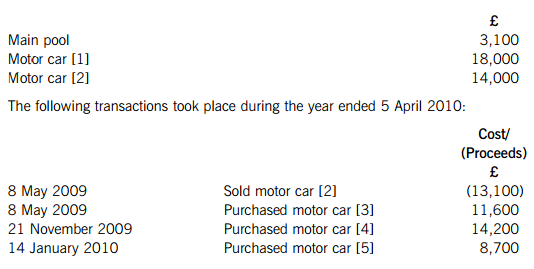

Plant and machinery

On 6 April 2009 the tax written down values of the partnership’s plant and machinery were as follows:

Motor car [1] has a CO2 emission rate of 185 grams per kilometre. It is used by Auy, and 70% of the mileage is for business journeys.

Motor car [4] purchased on 21 November 2009 has a CO2 emission rate of 135 grams per kilometre. Motor car [5] purchased on 14 January 2010 has a CO2 emission rate of 200 grams per kilometre. These two motor cars are used by employees of the business.

Profit sharing

Profits are shared 80% to Auy and 20% to Bim. This is after paying an annual salary of £4,000 to Bim, and interest at the rate of 5% on the partners’ capital account balances. The capital account balances are:

VAT

The partnership has been registered for VAT since 6 April 2000. However, the partnership has recently started invoicing for its services on new payment terms, and the partners are concerned about output VAT being accounted for at the appropriate time.

Required:

(a) Explain why both Auy Man and Bim Men will each be treated for tax purposes as resident in the United Kingdom for the tax year 2009–10.

(b) Calculate the partnership’s tax adjusted trading profit for the year ended 5 April 2010, and the trading income assessments of Auy Man and Bim Men for the tax year 2009–10.

Note: Your computation should commence with the net profit figure of £82,000, and should also list all of the items referred to in notes (2) to (5) indicating by the use of zero (0) any items that do not require adjustment. (15 marks)

(c) Calculate the class 4 national insurance contributions payable by Auy Man and Bim Men for the tax year 2009–10.

(d) (i) Advise the partnership of the VAT rules that determine the tax point in respect of a supply of services; (3 marks)

(ii) Calculate the amount of VAT paid by the partnership to HM Revenue & Customs throughout the year ended 5 April 2010;

Note: you should ignore the output VAT scale charges due in respect of fuel for private journeys. (2 marks)

(iii) Advise the partnership of the conditions that it must satisfy in order to join and continue to use the VAT flat rate scheme, and calculate the tax saving if the partnership had used the flat rate scheme to calculate the amount of VAT payable throughout the year ended 5 April 2010.

Note: you should assume that the relevant flat rate scheme percentage for the partnership’s trade was 11% throughout the whole of the year ended 5 April 2010. (5 marks)

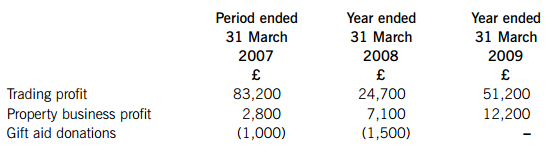

2.(a) You should assume that today’s date is 28 March 2010. Mice Ltd commenced trading on 1 July 2006 as a manufacturer of computer peripherals. The company prepares accounts to 31 March, and its results for the first three periods of trading were as follows:

The following information is available in respect of the year ended 31 March 2010:

Trading loss

Mice Ltd expects to make a trading loss of £180,000.

Business property income

Mice Ltd lets out three office buildings that are surplus to requirements.

The first office building is owned freehold. The property was let throughout the year ended 31 March 2010 at a quarterly rent of £3,200, payable in advance. Mice Ltd paid business rates of £2,200 and insurance of £460 in respect of this property for the year ended 31 March 2010. During June 2009 Mice Ltd repaired the existing car park for this property at a cost of £1,060, and then subsequently enlarged the car park at a cost f £2,640.

The second office building is owned leasehold. Mice Ltd pays an annual rent of £7,800 for this property, but did not pay a premium when the lease was acquired. On 1 April 2009 the property was sub-let to a tenant, with Mice Ltd receiving a premium of £18,000 for the grant of an eight-year lease. The company also received the annual rent of £6,000 which was payable in advance. Mice Ltd paid insurance of £310 in respect of this property for the year ended 31 March 2010.

The third office building is also owned freehold. Mice Ltd purchased the freehold of this building on 1 January 2010, and it will be empty until 31 March 2010. The building is to be let from 1 April 2010 at a monthly rent of £640, and on 15 March 2010 Mice Ltd received three months rent in advance. On 1 January 2010 Mice Ltd paid insurance of £480 in respect of this property for the year ended 31 December 2010, and during February 2010 spent £680 on advertising for tenants. Mice Ltd paid loan interest of £1,800 in respect of the period 1 January 2010 to 31 March 2010 on a loan that was taken out to purchase this property.

Loan interest received

On 1 July 2009 Mice Ltd made a loan for non-trading purposes. Loan interest of £6,400 was received on 31 December 2009, and £3,200 will be accrued at 31 March 2010.

Overseas dividend

On 15 October 2009 Mice Ltd received a dividend of £7,400 (net) from a 3% shareholding in USB Inc, a company that is resident overseas. Withholding tax was withheld from this dividend at the rate of 7?5%.

Chargeable gain

On 20 December 2009 Mice Ltd sold its 3% shareholding in USB Inc. The disposal resulted in a chargeable gain of £10,550, after taking account of indexation.

Required:

(i) Calculate Mice Ltd’s property business profit for the year ended 31 March 2010; (8 marks)

(ii) Assuming that Mice Ltd claims relief for its trading loss as early as possible, calculate the company’s profits chargeable to corporation tax for the nine-month period ended 31 March 2007, and each of the years ended 31 March 2008, 2009 and 2010. (7 marks)

(b) Mice Ltd has owned 100% of the ordinary share capital of Web-Cam Ltd since it began trading on 1 April 2009. For the three-month period ended 30 June 2009 Web-Cam Ltd made a trading profit of £28,000, and is expected to make a trading profit of £224,000 for the year ended 30 June 2010. Web-Cam Ltd has no other taxable profits or allowable losses.

Required:

Assuming that Mice Ltd does not make any loss relief claim against its own profits, advise Web-Cam Ltd as to the maximum amount of group relief that can be claimed from Mice Ltd in respect of the trading loss of £180,000 for the year ended 31 March 2010. (3 marks)

(c) Mice Ltd has surplus funds of £75,000 which it is planning to spend before 31 March 2010. The company will either purchase new equipment for £75,000, or alternatively it will purchase a new ventilation system for £75,000, which will be installed as part of its factory.

Mice Ltd has not made any other purchases of assets during the year ended 31 March 2010, and neither has its subsidiary company Web-Cam Ltd.

Required:

Explain the maximum amount of capital allowances that Mice Ltd will be able to claim for the year ended 31 March 2010 in respect of each of the two alternative purchases of assets.

Note: You are not expected to recalculate Mice Ltd’s trading loss for the year ended 31 March 2010, or redo any of the calculations made in parts (a) and (b) above. (4 marks)

(d) Mice Ltd is planning to pay its managing director a bonus of £40,000 on 31 March 2010. The managing director has already been paid gross director’s remuneration of £80,000 during the tax year 2009–10, and the bonus of £40,000 will be paid as additional director’s remuneration.

Required:

Advise the managing director as to the additional amount of income tax and national insurance contributions (both employee’s and employer’s) that will be payable as a result of the payment of the additional director’s remuneration of £40,000.

Note: You are not expected to recalculate Mice Ltd’s trading loss for the year ended 31 March 2010, or redo any of the calculations made in parts (a) and (b) above. (3 marks)

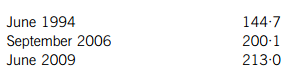

3.Problematic Ltd sold the following assets during the year ended 31 March 2010:

(1) On 14 June 2009 16,000 £1 ordinary shares in Easy plc were sold for £54,400. Problematic Ltd had originally purchased 15,000 shares in Easy plc on 26 June 1994 for £12,600. On 28 September 2006 Easy plc made a 1 for 3 rights issue. Problematic Ltd took up its allocation under the rights issue in full, paying £2?20 for each new share issued. The relevant retail prices indexes (RPIs) are as follows:

(2) On 1 October 2009 an office building owned by Problematic Ltd was damaged by a fire. The indexed cost of the office building on that date was £169,000. The company received insurance proceeds of £36,000 on 10 October 2009, and spent a total of £41,000 during October 2009 on restoring the office building. Problematic Ltd has made a claim to defer the gain arising from the receipt of the insurance proceeds. The office building has never been used for business purposes.

(3) On 28 January 2010 a freehold factory was sold for £171,000. The indexed cost of the factory on that date was £127,000. Problematic Ltd has made a claim to holdover the gain on the factory against the cost of a replacement leasehold factory under the rollover relief (replacement of business assets) rules. The leasehold factory has a lease period of 20 years, and was purchased on 10 December 2009 for £154,800. The two factory buildings have always been used entirely for business purposes.

(4) On 20 February 2010 an acre of land was sold for £130,000. Problematic Ltd had originally purchased four acres of land, and the indexed cost of the four acres on 20 February 2010 was £300,000. The market value of the unsold three acres of land as at 20 February 2010 was £350,000. Problematic Ltd incurred legal fees of £3,200 in connection with the disposal. The land has never been used for business purposes.

Problematic Ltd’s only other income for the year ended 31 March 2010 is a tax adjusted trading profit of £108,055.

Required:

(a) Calculate Problematic Ltd’s profits chargeable to corporation tax for the year ended 31 March 2010. (16 marks)

(b) Advise Problematic Ltd of the carried forward indexed base costs for capital gains purposes of any assets included in (1) to (4) above that are still retained at 31 March 2010. (4 marks)

4.You should assume that today’s date is 30 June 2011.

You are a trainee Chartered Certified Accountant and are dealing with the tax affairs of Ernest Vader.

Ernest’s self-assessment tax return for the tax year 2009–10 was submitted to HM Revenue & Customs (HMRC) on 15 May 2010, and Ernest paid the resulting income tax liability by the due date of 31 January 2011. However, you have just discovered that during the tax year 2009–10 Ernest disposed of a freehold property, the details of which were omitted from his self-assessment tax return. The capital gains tax liability in respect of this disposal is £18,000, and this amount has not been paid.

Ernest has suggested that since HMRC’s right to raise an enquiry into his self-assessment tax return for the tax year 2009–10 expired on 15 May 2011, no disclosure should be made to HMRC of the capital gain.

Required:

(a) Briefly explain the difference between tax evasion and tax avoidance, and how HMRC would view the situation if Ernest Vader does not disclose his capital gain. (3 marks)

(b) Briefly explain from an ethical viewpoint how you, as a trainee Chartered Certified Accountant, should deal with the suggestion from Ernest Vader that no disclosure is made to HMRC of his capital gain. (3 marks)

(c) State the action HMRC will take should they wish to obtain information from Ernest Vader regarding his capital gain. (1 mark)

(d) Explain why, even though the right to raise an enquiry has expired, HMRC will still be entitled to raise an assessment should they discover that Ernest Vader has not disclosed his capital gain. (2 marks)

(e) Assuming that HMRC discover the capital gain and raise an assessment in respect of Ernest Vader’s capital gains tax liability of £18,000 for the tax year 2009–10, and that this amount is then paid on 31 July 2011:

(i) Calculate the amount of interest that will be payable; Note: you should assume that the rates for the tax year 2009–10 continue to apply. (2 marks)

(ii) Advise Ernest Vader as to the amount of penalty that is likely to be charged as a result of the failure to notify HMRC, and how this could have been reduced if the capital gain had been disclosed. (4 marks)

5.For the year ended 31 January 2010 Quagmire plc had profits chargeable to corporation tax of £1,200,000 and franked investment income of £200,000. For the year ended 31 January 2009 the company had profits chargeable to corporation tax of £1,600,000 and franked investment income of £120,000.

Quagmire plc’s profits accrue evenly throughout the year.

Quagmire plc has one associated company. Required:

(a) Explain why Quagmire plc will have been required to make quarterly instalment payments in respect of its corporation tax liability for the year ended 31 January 2010. (3 marks)

(b) Calculate Quagmire plc’s corporation tax liability for the year ended 31 January 2010, and explain how and when this will have been paid. (3 marks)

(c) Explain how your answer to part (b) above would differ if Quagmire plc did not have an associated company. Your answer should include a calculation of the revised corporation tax liability for the year ended 31 January 2010. (4 marks)

请帮忙给出每个问题的正确答案和分析,谢谢!

第6题

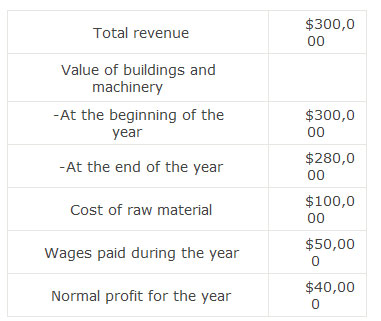

The company’s economic profit is closest to:

A. $90,000

B. $110,000

C. $130,000

第7题

A company’s draft financial statements for 2005 showed a profit of $630,000. However, the trial balance did not agree,

and a suspense account appeared in the company’s draft balance sheet.

Subsequent checking revealed the following errors:

(1) The cost of an item of plant $48,000 had been entered in the cash book and in the plant account as $4,800.

Depreciation at the rate of 10% per year ($480) had been charged.

(2) Bank charges of $440 appeared in the bank statement in December 2005 but had not been entered in the

company’s records.

(3) One of the directors of the company paid $800 due to a supplier in the company’s payables ledger by a personal

cheque. The bookkeeper recorded a debit in the supplier’s ledger account but did not complete the double entry

for the transaction. (The company does not maintain a payables ledger control account).

(4) The payments side of the cash book had been understated by $10,000.

9 Which of the above items would require an entry to the suspense account in correcting them?

A All four items

B 3 and 4 only

C 2 and 3 only

D 1, 2 and 4 only

第8题

•Choose the best word to fill each gap from A, B, C or D on the opposite page.

•For each question (19-33), mark one letter (A, B, C or D) on your Answer Sheet.

Chairman's Report

I am pleased to report that, although we had been expecting poor results for this half year because of slow growth in the world economy, the company has performed very satisfactorily. Operating profits for this first half are in fact very much (19) with those for the corresponding (20) last year. Profits reached £115 million before tax, compared with£116.3 million last year. Much of our success in the last six months can be (21) to the fact. that all our major construction projects remained on schedule. Particularly pleasing was the early (22) of a major building contract in Canada.

The company has made good progress with the initiatives announced at the Annual General Meeting. The majority of shareholders (23) the Board's decision to sell the company's loss-making engineering (24) It was the Board's belief that the company would (25) most benefit by (26) its resources on the expansion of its construction activities. Negotiations with a potential buyer began in February and are now at a critical (27) However, we feel that we are not as yet in a (28) to comment on what the outcome is likely to be.

In June, we made a successful (29) for the Renishaw Construction Company of Hong Kong SAR, in order to give us greater (30) to markets in South East Asia. We still have sufficient resources to pursue our growth (31) and are at present (32) several other business opportunities which, like Renishaw Construction, would (33) new markets to us.

(19)

A.in order

B.on track

C.in line

D.on target

第9题

A.reduction in the number of employees

B.improvement of working conditions

C.fewer disputes between labor and management

D.a rise in workers' wages

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!

微信搜一搜

微信搜一搜

上学吧

上学吧

微信搜一搜

微信搜一搜

上学吧

上学吧