题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Cash paid for merchandise is an operating activity.

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

更多“Cash paid for merchandise is a…”相关的问题

更多“Cash paid for merchandise is a…”相关的问题

第1题

第2题

第3题

第4题

A.days sales payable (DSP).

B.gains on the sale of long-term assets.

C.use of operating leases versus financing leases.

第5题

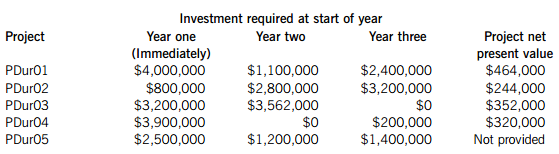

The Durvo department is considering the following five investment projects with three years of initial investment expenditure, followed by several years of positive cash inflows. The department’s initial investment expenditure limits are $9,000,000, $6,000,000 and $5,000,000 for years one, two and three respectively. None of the projects can be deferred and all projects can be scaled down but not scaled up.

PDur05 project’s annual operating cash flows commence at the end of year four and last for a period of 15 years. The project generates annual sales of 300,000 units at a selling price of $14 per unit and incurs total annual relevant costs of $3,230,000. Although the costs and units sold of the project can be predicted with a fair degree of certainty, there is considerable uncertainty about the unit selling price. The department uses a required rate of return of 11% for its projects, and inflation can be ignored.

The Durvo department’s managing director is of the opinion that all projects which return a positive net present value should be accepted and does not understand the reason(s) why Arbore Co imposes capital rationing on its departments. Furthermore, she is not sure why maintaining a capital investment monitoring system would be beneficial to the company.

Required:

(a) Calculate the net present value of project PDur05. Calculate and comment on what percentage fall in the selling price would need to occur before the net present value falls to zero. (6 marks)

(b) Formulate an appropriate capital rationing model, based on the above investment limits, that maximises the net present value for department Durvo. Finding a solution for the model is not required. (3 marks)

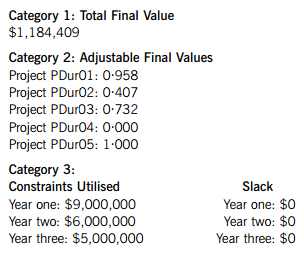

(c) Assume the following output is produced when the capital rationing model in part (b) above is solved:

Required:

Explain the figures produced in each of the three output categories. (5 marks)

(d) Provide a brief response to the managing director’s opinions by:

(i) Explaining why Arbore Co may want to impose capital rationing on its departments; (2 marks)

(ii) Explaining the features of a capital investment monitoring system and discussing the benefits of maintaining such a system. (4 marks)

第7题

A. class B common stock

B. preferred stock

C. treasury stock

D. class A common stock

第8题

estimated information relates:

(1) An initial investment of $45m in equipment at the beginning of year 1 will be depreciated on a straight-line basis

over a three-year period with a nil residual value at the end of year 3.

(2) Net operating cash inflows in each of years 1 to 3 will be $12·5m, $18·5m and $27m respectively.

(3) The management accountant of Alpha Division has estimated that the NPV of the investment would be

$1·937m using a cost of capital of 10%.

(4) A bonus scheme which is based on short-term performance evaluation is in operation in all divisions within the

Delta Group.

Required:

(a) (i) Calculate the residual income of the proposed investment and comment briefly (using ONLY the above

information) on the values obtained in reconciling the short-term and long-term decision views likely to

be adopted by divisional management regarding the viability of the proposed investment. (6 marks)

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!

微信搜一搜

微信搜一搜

上学吧

上学吧

微信搜一搜

微信搜一搜

上学吧

上学吧