题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A company's income before interest expense and taxes is $250,000 and its interest expense is $100,000. Please to compute its times interest earned ratio.

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

更多“A company's income before inte…”相关的问题

更多“A company's income before inte…”相关的问题

第1题

A、Milroy can deduct $800,000 of interest expense

B、Milroy can deduct $600,000 of interest expense and can carry forward the remaining $200,000 indefinitely

C、Milroy can deduct $600,000 of interest expense and the remaining $200,000 can not be carried forward

D、Milroy can deduct $600,000 of interest expense and can carry back the remaining $200,0003 years

E、Milroy cannot deduct any interest expense

第2题

A.3 times

B.4 times

C.3.5 times

D.5 times

第3题

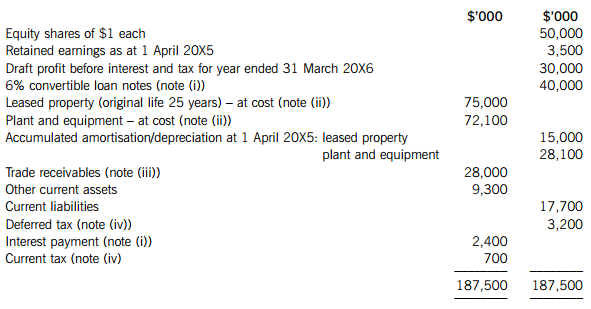

The following notes are relevant:

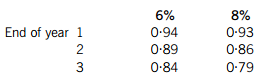

(i) Triage Co issued 400,000 $100 6% convertible loan notes on 1 April 20X5. Interest is payable annually in arrears on 31 March each year. The loans can be converted to equity shares on the basis of 20 shares for each $100 loan note on 31 March 20X8 or redeemed at par for cash on the same date. An equivalent loan without the conversion rights would have required an interest rate of 8%.

The present value of $1 receivable at the end of each year, based on discount rates of 6% and 8%, are:

(ii) Non-current assets:

The directors decided to revalue the leased property at $66·3m on 1 October 20X5. Triage Co does not make an annual transfer from the revaluation surplus to retained earnings to reflect the realisation of the revaluation gain; however, the revaluation will give rise to a deferred tax liability at the company’s tax rate of 20%.

The leased property is depreciated on a straight-line basis and plant and equipment at 15% per annum using the reducing balance method.

No depreciation has yet been charged on any non-current assets for the year ended 31 March 20X6.

(iii) In September 20X5, the directors of Triage Co discovered a fraud. In total, $700,000 which had been included as receivables in the above trial balance had been stolen by an employee. $450,000 of this related to the year ended 31 March 20X5, the rest to the current year. The directors are hopeful that 50% of the losses can be recovered from the company’s insurers.

(iv) A provision of $2·7m is required for current income tax on the profit of the year to 31 March 20X6. The balance on current tax in the trial balance is the under/over provision of tax for the previous year. In addition to the temporary differences relating to the information in note (ii), at 31 March 20X6, the carrying amounts of Triage Co’s net assets are $12m more than their tax base.

Required:

(a) Prepare a schedule of adjustments required to the draft profit before interest and tax (in the above trial balance) to give the profit or loss of Triage Co for the year ended 31 March 20X6 as a result of the information in notes (i) to (iv) above.

(b) Prepare the statement of financial position of Triage Co as at 31 March 20X6.

(c) The issue of convertible loan notes can potentially dilute the basic earnings per share (EPS). Calculate the diluted earnings per share for Triage Co for the year ended 31 March 20X6 (there is no need to calculate the basic EPS).

Note: A statement of changes in equity and the notes to the statement of financial position are not required.

The following mark allocation is provided as guidance for this question:

(a) 5 marks

(b) 12 marks

(c) 3 marks

第4题

The company’s 2012 income tax expense (in thousands) is closest to:

A. $1,000.

B. $1,050.

C. $1,250.

第5题

capital of Hira Ltd from Belgrove Ltd. Belgrove Ltd currently owns 100% of the share capital of Hira Ltd and has no

other subsidiaries. All three companies have their head offices in the UK and are UK resident.

Hira Ltd had trading losses brought forward, as at 1 April 2006, of £18,600 and no income or gains against which

to offset losses in the year ended 31 March 2006. In the year ending 31 March 2007 the company expects to make

further tax adjusted trading losses of £55,000 before deduction of capital allowances, and to have no other income

or gains. The tax written down value of Hira Ltd’s plant and machinery as at 31 March 2006 was £96,000 and

there will be no fixed asset additions or disposals in the year ending 31 March 2007. In the year ending 31 March

2008 a small tax adjusted trading loss is anticipated. Hira Ltd will surrender the maximum possible trading losses

to Belgrove Ltd and Dovedale Ltd.

The tax adjusted trading profit of Dovedale Ltd for the year ending 31 March 2007 is expected to be £875,000 and

to continue at this level in the future. The profits chargeable to corporation tax of Belgrove Ltd are expected to be

£38,000 for the year ending 31 March 2007 and to increase in the future.

On 1 February 2007 Dovedale Ltd will sell a small office building to Hira Ltd for its market value of £234,000.

Dovedale Ltd purchased the building in March 2005 for £210,000. In October 2004 Dovedale Ltd sold a factory

for £277,450 making a capital gain of £84,217. A claim was made to roll over the gain on the sale of the factory

against the acquisition cost of the office building.

On 1 April 2007 Dovedale Ltd intends to acquire the whole of the ordinary share capital of Atapo Inc, an unquoted

company resident in the country of Morovia. Atapo Inc sells components to Dovedale Ltd as well as to other

companies in Morovia and around the world.

It is estimated that Atapo Inc will make a profit before tax of £160,000 in the year ending 31 March 2008 and will

pay a dividend to Dovedale Ltd of £105,000. It can be assumed that Atapo Inc’s taxable profits are equal to its profit

before tax. The rate of corporation tax in Morovia is 9%. There is a withholding tax of 3% on dividends paid to

non-Morovian resident shareholders. There is no double tax agreement between the UK and Morovia.

Required:

(a) Advise Belgrove Ltd of any capital gains that may arise as a result of the sale of the shares in Hira Ltd. You

are not required to calculate any capital gains in this part of the question. (4 marks)

第6题

What is the theoretical value of the company?

A.$20m

B.$40m

C.$50m

D.$25m

第7题

A. liabilities when calculating the company’s current ratio.

B. equity when calculating the company’s return on equity ratio.

C. liabilities when calculating the company’s debt-to-equity ratio.

第8题

Choose the best word to fill each gap from A, B, C or D on the opposite page.

Another successful year

The UK-based agricultural and garden equipment group PLT has had another successful year and is looking forward to the future with. The group, which also has distribution and fuel (19) has enjoyed record profits for the fifth year in a (20) Pre-tax profits for the year (21) March 31 rose by 24 per cent to £4.2 million. Total group sales (22) by five per cent to £155 million, with the agricultural business delivering yet another record (23) despite the somewhat difficult trading (24) in the industry. Sales in the garden equipment (25) were slow in the early months of the year, but increased dramatically in the final quarter.

Chairman Suresh Kumar said, 'It is my (26) that we have continued to grow by (27) our customers well. I am delighted to (28) the continued development of our customer (29) and I would like to thank all our customers for their (30) As well as an increase in customers, our staff numbers also continue to grow. During the year, we have taken (31) 58 new employees, so that our total workforce now numbers in excess of 700. All of the staff deserve my praise for their dedication and continued efforts in (32) these excellent results.' The group has proposed a final (33) of 9.4p per share, bringing the total to 13p for the year.

(19)

A.commitments

B.interests

C.responsibilities

D.benefits

第9题

A.$92·67

B.$108·90

C.$89·93

D.$103·14

第10题

Choose the best word to fill each gap from A, B, C or D on the opposite page.

Fighting Fit

Fine Fitness, the health and fitness club operator, an impressive set of results yesterday. (19) a 38-per-cent jump in annual pre-tax profits, the company claimed that it had (20) none of the problems (21) last week by its rival, Top Fit. According to Samantha Collier, the chief executive, Fine Fitness (22) strong and is on (23) to reach its target of 100 clubs within three years, its strategy unaffected by the apparent (24) down of the economy.

The company opened 12 new clubs in the past year, (25) its total to 51. They have (26) to be highly successful, with people joining in large numbers, especially in the 25-to-40 age range. Even the more (27) clubs are still seeing sales growth, along with rising retention (28) of more than 70 per cent. This can be seen as clear (29) of the appeal of Fine Fitness. Ms Collier admitted that as there were (31) too many companies competing with one another, there would almost certainly be (31) in the health-and-fitness-club sector of the market. She predicted that, within a relatively short time, there might be only about three major companies still in (32) However, she declined to say which these were likely to be. Profits rose by ~6.3 million, although there was a fall in gross margins from 31 per cent to 28.6 per cent because of higher insurance premiums, extra management costs and start-up expenses for the company's new (33) in Spain.

(19)

A.Stating

B.Reporting

C.Remarking

D.Informing

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!

微信搜一搜

微信搜一搜

上学吧

上学吧

微信搜一搜

微信搜一搜

上学吧

上学吧