题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Normal loss is considered as the cost of business, thus not sharing the production cost.

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

如搜索结果不匹配,请 联系老师 获取答案

如搜索结果不匹配,请 联系老师 获取答案

更多“Normal loss is considered as t…”相关的问题

更多“Normal loss is considered as t…”相关的问题

第1题

A. The cost of the materials used to produce a widget.

B. The labor costs of the workers who actually produced the widget.

C. The rent for the building in which the widget was manufactured

D. The salary of senior management and the project sponsor

E. A and B only

第2题

A . The cost of the materials used to produce a widget.

B . The labor costs of the workers who actually produced the widget.

C . The rent for the building in which the widget was manufactured

D . The salary of senior management and the project sponsor

E . A and B only

第3题

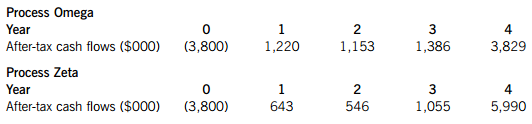

The annual after-tax cash flows for each process are as follows:

Tisa Co has 10 million 50c shares trading at 180c each. Its loans have a current value of $3·6 million and an average after-tax cost of debt of 4·50%. Tisa Co’s capital structure is unlikely to change significantly following the investment in either process.

Elfu Co manufactures electronic parts for cars including the production of a component similar to the one being considered by Tisa Co. Elfu Co’s equity beta is 1·40, and it is estimated that the equivalent equity beta for its other activities, excluding the component production, is 1·25. Elfu Co has 400 million 25c shares in issue trading at 120c each. Its debt finance consists of variable rate loans redeemable in seven years. The loans paying interest at base rate plus 120 basis points have a current value of $96 million. It can be assumed that 80% of Elfu Co’s debt finance and 75% of Elfu Co’s equity finance can be attributed to other activities excluding the component production.

Both companies pay annual corporation tax at a rate of 25%. The current base rate is 3·5% and the market risk premium is estimated at 5·8%.

Required:

(a) Provide a reasoned estimate of the cost of capital that Tisa Co should use to calculate the net present value of the two processes. Include all relevant calculations. (8 marks)

(b) Calculate the internal rate of return (IRR) and the modified internal rate of return (MIRR) for Process Omega. Given that the IRR and MIRR of Process Zeta are 26·6% and 23·3% respectively, recommend which process, if any, Tisa Co should proceed with and explain your recommendation. (8 marks)

(c) Elfu Co has estimated an annual standard deviation of $800,000 on one of its other projects, based on a normal distribution of returns. The average annual return on this project is $2,200,000.

Required:

Estimate the project’s Value at Risk (VAR) at a 99% confidence level for one year and over the project’s life of five years. Explain what is meant by the answers obtained. (4 marks)

第4题

A.at times

B.at present

C.at once

D.at a time

第5题

A.on occasions

B.at a time

C.under the circumstances

D.at once

第6题

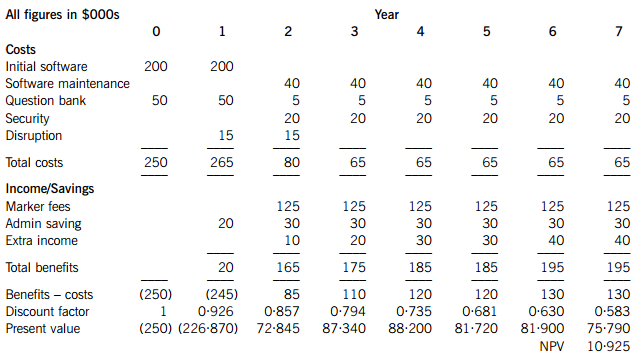

Figure 1: Financial cost/benefit of the computer-based assessment project

An explanation of the costs and benefits is given below.

Initial software – refers to the cost of buying the computer-based assessment software package from the vendor. The software actually costs $375,000, but a further $25,000 has been added to reflect bespoke changes which the IIA requires. These changes are not yet agreed, or defined in detail. Indeed, there have been some problems in actually specifying these requirements and understanding how they will affect the administrative processes of the IIA.

Software maintenance – This will be priced at 10% of the final cost of the delivered software. This is currently estimated at $400,000; hence a cost of $40,000 per annum.

Question bank – refers to the cost of developing a question bank for the project. This is a set of questions which the software package stores and selects from when producing an examination for an individual candidate. Questions will be set by external consultants at $50 for each question they successfully deliver to the question bank. It is expected that further questions will need to be added (and current ones amended) in subsequent years.

Security – refers to security provided at computer-based assessment centres. This price has already been agreed with an established security firm who have guaranteed it for the duration of the project.

Disruption – refers to an expected temporary decline in IIA examinations staff productivity and staff morale during the implementation of the computer-based assessment solution.

Marker fees – manual marking is undertaken in the current conventional assessment process. There will no longer be any requirement for markers to undertake this manual marking. All examinations will be automatically marked.

Admin saving – concerns reduction in examinations staff at IIA headquarters. The actual savings will partly depend on the detailed requirements currently being discussed with the software package provider. It is still unclear how this will affect the administrative process.

Extra income – the IIA expects candidates to be attracted by the convenience of computer-based assessment. Other competing institutions do not offer this service. The extra income is the IIA’s best guess at the amount of income which will result from this new assessment initiative.

The IIA is also putting in place a benefits management process for all projects. The IIA director is concerned that project managers are just moving on to other projects and not taking responsibility for the benefits initially established in the business case.

Required:

(a) Critically evaluate the financial case (cost/benefit) of the computer-based assessment project. (15 marks)

(b) Benefit owners, benefits maps and benefits realisation are important concepts in benefits management process.

Explain each of these concepts and their potential application to the computer-based assessment project. (10 marks)

第7题

The theme park is expected to attract an average of 15,000 visitors per day for at least four years, after which major new investment would be required in order to maintain demand. The price of admission to the theme park is expected to be £18 per adult and £10 per child. 60% of visitors are forecast to be children. In addition to admission revenues,

it is expected that the average visitor will spend £8 on food and drinks, (of which 30% is profit), and £5 on gifts and souvenirs, (of which 40% is profit). The park would open for 360 days per year.

All costs and receipts (excluding maintenance and construction costs and the realisable value) are shown at current prices; the company expects all costs and receipts to rise by 3% per year from current values.

The theme park would cost a total of £400 million and could be constructed and working in one year’s time. Half of the £400 million would be payable immediately, and half in one year’s time. In addition working capital of £50 million will be required from the end of year one. The after tax realisable value of fixed assets is expected to be between £250 million and £300 million after four years of operation.

Maintenance costs (excluding labour) are expected to be £15 million in the first year of operation, increasing by £4 million per year thereafter. Annual insurance costs are £2 million, and the company would apportion £2·5 million per year to the theme park from existing overheads. The theme park would require 1,500 staff costing a total of £40 million per annum (at current prices). Sleepon will use the existing advertising campaigns for its hotels to also advertise the theme park. This will save approximately £2 million per year in advertising expenses.

As Sleepon has no previous experience of theme park management, it has investigated the current risk and financial structure of the closest UK theme park competitor, Thrillall plc. Details are summarised below.

Thrillall plc, summarised balance sheet

Other information:

(i) Sleepon has access to a £450 million Eurosterling loan at 7·5% fixed rate to provide the necessary finance for the theme park.

(ii) £250 million of the investment will attract 25% per year capital allowances on a reducing balance basis.

(iii) Corporate tax is at a rate of 30%.

(iv) The average stock market return is 10% and the risk free rate 3·5%.

(v) Sleepon’s current weighted average cost of capital is 9%.

(vi) Sleepon’s market weighted gearing if the theme park project is undertaken is estimated to be 61·4% equity,

38·6% debt.

(vii) Sleepon’s equity beta is 0·70.

(viii) The current share price of Sleepon is 148 pence, and of Thrillall 386 pence.

(ix) Thrillall’s medium and long term debt comprises long term bonds with a par value of £100 and current market price of £93.

(x) Thrillall’s equity beta is 1·45.

Required:

Prepare a report analysing whether or not Sleepon should undertake the investment in the theme park. Your report should include a discussion of what other information would be useful to Sleepon in making the investment decision. All relevant calculations must be included in the report or as an appendix to it. State clearly any assumptions that you make.

(Approximately 28 marks are available for calculations and 12 for discussion)

(40 marks)

第9题

Tax-Less Software Corporation is considering an investment of $400,000 in equipment for producing a new tax preparation software package. The equipment has an expected life of 4 years. Sales are expected to be 60,000 units per year at a price of $20 per unit. Fixed costs excluding depreciation of the equipment are $200,000 per year, and variable costs are $12 per unit. The equipment will be depreciated over 4 years using the straight line method with a zero salvage value. Working capital requirements are assumed to be 1/12 of annual sales. The market capitalization rate for the project is 15% per year, and the corporation pays income tax at the rate of 34%. What is the project’s NPV? What is the breakeven volume?

A、$181,845 & 37,500

B、$191,845 & 38,500

C、$191,845 & 40,500

D、$181,845 & 39,500

第10题

IS A COLLEGE DEGREE NECESSARY IN TODAY'S WORLD?

In the first part of your writing you should present your thesis statement, and in the second part you should support the thesis statement with appropriate details. In the last part you should bring what you have written to a natural conclusion or a summary.

Marks will be awarded for content, organisation, grammar and appropriateness. Failure to follow the above instructions may result in a loss of marks.

Write your composition on ANSWER SHEET FOUR.

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!

微信搜一搜

微信搜一搜

上学吧

上学吧

微信搜一搜

微信搜一搜

上学吧

上学吧